Sporting goods giant NIKE Inc continues to pin its hopes on speed and scale as the driving forces for future growth – and is already getting faster in creating, making and delivering its products.

“The consumer today expects a premium experience, with innovative product and services delivered faster and more personally,” Nike chairman, president and CEO Mark Parker told the company’s investor day in Oregon this week.

“Fuelled by a transformation of our business, we are attacking growth opportunities through innovation, speed and digital to accelerate long-term, sustainable and profitable growth.”

The business has set its sights on high-single digit revenue growth, expanding margins and mid-teens earnings per share growth on average over the next five years.

And it believes that in order to achieve this it needs to make sneakers faster, and sell more personalised products directly to consumers.

See Also:

This so-called ‘Consumer Direct Offense’ was unveiled earlier this year and focuses on growth through key categories across 12 key cities and 10 key countries that are expected to represent over 80% of Nike’s projected growth through 2020: New York, London, Shanghai, Beijing, Los Angeles, Tokyo, Paris, Berlin, Mexico City, Barcelona, Seoul and Milan.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe strategy is, in turn, fuelled by the company’s ‘Triple Double’ strategy – 2X Innovation, 2X Speed and 2X Direct connections with consumers – which is being ramped up.

“We expect that over the next five years, over 50% of our growth will originate from new innovation concepts that will scale across multiple categories. We expect that digital revenue, both owned and through partners, will increase from nearly 15% today to over 30%. And nearly 3/4 of our growth will come from outside the US,” Parker says.

Elaborating further, the company aims to move from seeding to scaling a lot faster, reducing the average product creation timeline by more than half. “We’ll edit to amplify to give consumers better choices to match their preferences. And we’ll set a new expectation for style…to the consumer, there is no trade-off between sport and style.”

And one of the best ways of serving the insatiable consumer demand for new and fresh products is to digitise as much of the process as possible.

“We’re building new capabilities and analytics to deliver personalised products in real time, and we’re engaging with more partners, company-wide, to move faster against our goals. In our supply chain, we’ve joined forces with leading robotics and automation companies, and we’re serving millions of athletes and sports fans faster through manufacturing bases that are closer to our North American consumer.

“2X Speed is really all about delivering the right product in the moment, 100% of the time,” Parker adds.

“We’re laser-focused on getting faster, and we know one of the best ways to do that is to digitise as much of the process as we can, as quickly as we can”

“We’re laser-focused on getting faster, and we know one of the best ways to do that is to digitise as much of the process as we can, as quickly as we can,” agrees chief operating officer Eric Sprunk. “We’re making it smarter, more connected and more automated to get closer to consumers more quickly. But we all know there is so much more we can do.”

His vision for the future: “Our consumer can place an order and have it delivered the same day in key cities around the world. Your favorite team wins a championship. And in a few days, we have designed, manufactured and delivered brand-distinctive, innovative product to your doorstep. Not just for certain products, not just in certain colours. For all of our products.

“The innovation and re-imagination of our end-to-end value chain allows us to serve these consumers in an unparalleled way. We have changed the paradigm in our industry from driving a strategy focused on where we make our product to how we make our product. So we can decide to make it anywhere we want.”

Getting bigger by getting faster

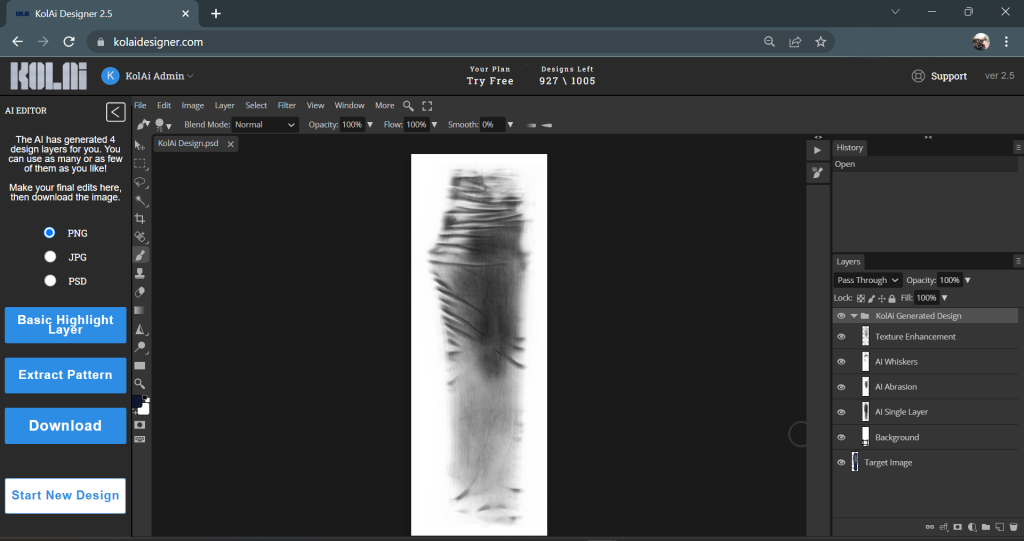

Progress has been made on all fronts, starting with digitising the product creation process and in rapid prototyping to dramatically reduce the time it takes to get to market, according to Michael Spillane, president, Product & Categories.

The bottom line: “We’re really big, but we’re going to get much bigger, because we’re getting much better,” he told investors. “We’re creating the space to be fast by being great editors.”

Starting this January, the company will put 25% fewer styles into the marketplace. “Editing down to fewer styles creates the space to amplify. Amplifying means more choices of the products that consumers already love.”

Editing out the noise also leads to better full-price sell-through, which leads to fewer markdowns, returns and higher gross margins as well as optimized inventory. All this adds up to consistent quality, long-term growth.

The company now has the ability to respond to insights faster than ever with ideas to shelf reducing to six months. In some case, Nike has gone from 90 weeks to 90 days for turnaround in certain areas like T-shirts. Other innovations include the FE/NOM Flyknit women’s sports bra, which is 30% lighter thanks to biometric testing; and the use of digital design tools to create the Epic React foam cushioning in one-third less time.

Nike unveils “new generation” Flyknit sports bra

This all comes together, in part, through ‘Express Lane’, which creates; updates existing models with new materials, colours and prints based on real-time consumer insights; and fulfils by ensuring products are in stock when and where consumers want them.

An example of the Express Lane in action is with the new Shox athletic shoe being relaunched for the holiday season across 11 “distinct characters” and 25 colourways.

“We used 3D modelling to rapidly visualise and design the product in just a few weeks. We went from design, to prototyping, to manufacturing, to delivery in less than six months, and now we’re doing it at scale,” Spillane explains.

“This is what disruption looks like. We’ve got a great consumer insight telling us what they wanted, propulsion with style. We reimagined the concept and moved it from idea to shelf in just 6 months. And now we’re scaling speed across our portfolio.

The complete value chain “will soon to be all digital, starting with design and development,” he added. “In footwear, for example, we’re deploying digital across every aspect of the business. We can now produce more than twice as many high-quality prototypes than traditional creation. Our goal is to rapid prototype 100% of the new innovations right here in Portland, Oregon.”

Shaking up the supply chain

Change is also being underpinned by a focus on developing “new methods of manufacturing and relentlessly driving automation in our traditional methods of make,” according to COO Sprunk. “We do it by both expanding these capabilities with our existing strategic partners and by bringing new manufacturers into the industry.”

Shaking up the supply chain is no mean feat given that Nike will ship 1.3 billion units in fiscal 2018, with products manufactured in 566 factories employing more than 1 million workers. These units are shipped through 75 distribution centres to more than 30,000 retailers in more than 190 countries.

“We are transforming the sophisticated global supply chain from one where a futures order was historically our signal to start supplying the market, into one where consumer demand is our signal to anticipate and respond,” Sprunk explains.

“We’re digitising our end-to-end supply chain and creating a model with shorter lead times to deliver what consumers want, when they want it, where they want it”

“To make this shift, we’re digitising our end-to-end supply chain and creating a model with shorter lead times to deliver what consumers want, when they want it, where they want it.”

Much of this has been made possible by its Advanced Product Creation Center (APCC) “where we dream, create, innovate and deliver on the future for Nike.”

In apparel, the company is also working with Tegra Global [a new regional apparel supply organisation being built for Nike by private equity giant Apollo Global Management] to create a vertically integrated and more responsive onshore and nearshore network to service North America apparel with closer-to-market manufacturing and embellishment.

One of the “new groundbreaking innovations” to come out of the APCC is in scaling the digital printing of high-quality graphics so the company can stage greige goods or blank materials, to delay colour and print decisions to the last possible moment, “delivering on our goal of closer to the end-market decision-making.”

Another is “an entirely new revolutionary method of make that transforms how we make footwear uppers,” by using advanced robotics and digitisation to deliver a continuous, automated sequential flow of upper-making production. With 30% fewer steps and up to 50% less labour, Nike says it can produce a complete pair of uppers in just 30 seconds at scale with less waste.

On the material front, a recent innovation is Nike Flyleather, a new recycled leather with at least 50% leather fibre that is 40% lighter and five times more abrasion-resistant than traditional full grain leather. Crucially, it is made on a roll versus leather coming from a hide, allowing it to make shoes much faster, with more flexibility and lower material costs.

Nike Flyleather as “game-changing” as Flyknit

The company is also revolutionising how it makes product in footwear. Its partnership with Flex to develop innovative footwear technologies has just moved into a new nearshore purpose-built footwear factory that will deliver over 3 million pairs to North America in fiscal year 18 alone. By 2023, together with Flex, “we plan to produce tens of millions of pairs nearshore with more than 25% of those volumes delivered through Nike Direct on a short lead time responsive model,” Sprunk says.

“This strategic relationship allows us to take our standard time from manufacturing to market from about 60 days to 10 days or less. And Flex isn’t just another contract manufacturer. We’re inventing new manufacturing capabilities at scale together.

“With Flex, we’re already commercialising Flyknit, end to end, 12 weeks faster than through our traditional manufacturing process. And we’re now also delivering responsive capabilities to North America consumers through experiences like our Flyknit iD pilot.

“You can go to Nike iD today, design your own customised Free Run Flyknit shoes and literally have them knitted to order. We promise to deliver them to you in under 10 days, but we’re hearing from consumers that many of them are getting them in three or four. This is real speed in creating shoes on demand.”

Global operations

Manufacturing innovation also extends across Nike’s entire sourcing base, especially with its Asian-based strategic partners where production has been modernised for more than 1,500 models of footwear across every category.

“With a focus on just four core technologies – cutting, cementing, assembly and bottom-making – we will have deployed more than 1,200 new automated machines by the end of this fiscal year,” Sprunk explained. “This is not about making one model in one factory. For us, this is about scaling digitisation, automation and robotics across our entire source base and across our entire product line.”

Putting numbers to this, he added that five of 11 new automated technologies used in the Air Jordan XIII drive around 30% less labour and a 50% increase in pairs per hour. “And most importantly, better product: more consistent and more precise.”

NikePlus membership

The investor day also saw the company unveil its new NikePlus membership programme, which will provide member-only access to certain products, matched to their individual preferences and buying patterns.

However, after predicting sales of $50bn by 2020 at Nike’s previous investor day two years ago, Parker was forced to concede the company would now reach the $50bn milestone “within the next five years.”

The business reported $34.4bn in sales for its last fiscal year, a rise of 6% on the year before, as net income increased 13% to $4.2bn.

However, it has been battling headwinds including a slowdown in athleticwear sales, especially at brick-and-mortar stores and rising inventories at traditional sports retailers.

Nike has also been hit by a rise in trends like streetwear with Vans and Supreme gaining momentum. In addition, other brands such as adidas, Puma and New Balance have been capturing more business from teens gravitating towards the 1990s retro look.

Nike losing its teen appeal, streetwear on the rise

In July the company responded with a sweeping restructuring plan, including cutting around 1,400 jobs or 2% of its global workforce.