UK retailers targeting younger consumers such as Primark and JD Sports are likely to see footfall return more quickly once lockdown restrictions are loosened than players aimed at the more cautious over 35s, according to data and analytics company GlobalData.

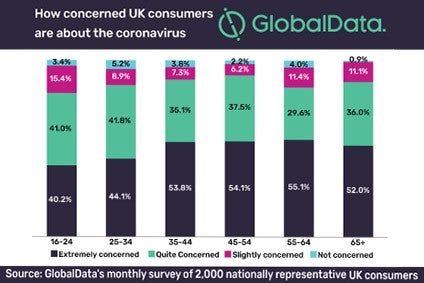

“Despite the majority of UK consumers remaining concerned about Covid-19, under 35s are slightly more optimistic likely to be due to the lower death rates amongst the young,” says Sofie Willmott, lead retail analyst at GlobalData.

“42% of under 35s are extremely concerned about coronavirus in comparison to 53.7% of over 35s. Those over 35 will feel more cautious about returning to non-essential retail stores once they are able to re-open and retailers will need to clearly communicate the safety measures they have in place to ease their worries.”

Retailers whose customers are primarily over 35 should prepare for online sales to remain inflated and should gear up warehouses to be able to cope with the ongoing demand while trying to improve delivery times that have been slowed down by social distancing measures being introduced.

“Younger consumers are ready for their lives to return to normal with 44.9% expecting this to happen by the end of June, if not sooner. Under 35s are likely to be those first back into non-essential shops as the risk of serious of consequences of Covid-19 is lower for them. Retailers such as JD Sports and Primark will see the benefit as young consumers are eager to leave the house after weeks of restrictions,” Willmott adds.

See Also:

“15.7% of over 35s do not expect things to return to normal until the end of the year (versus 10.2% of under 35s) so will be prepared to stay home for a longer period and it will be harder for retailers such as Marks & Spencer and John Lewis & Partners to coax their customers back into branches.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Following the initial instructions from the government to stay at home for 12 weeks, many older consumers are not convinced this is long enough with almost one fifth expecting to wait till the end of the year until their lives return to normal.”

UK lockdown began on 23 March, when many non-essential stores temporarily ceased trading to try to halt the spread of the coronavirus.

The closure of non-essential retail in the UK equates to 382m sq ft of physical space out of action – space that would have generated GBP14.5bn (US$18.1bn) of revenue over that period based on 2019 sales, according to GlobalData.

Clothing and footwear is the UK retail sector likely to be worst hit by the coronavirus. The crisis has seen department store group Debenhams fall into administration and 1,803 jobs lost at the Oasis and Warehouse Group after administrators were unable to secure a buyer for the fashion business.

Online clothing brand Harpenne, which is owned by UK high street retailer River Island, has also permanently closed less than a year after its launch.

UK retail sales slumped to new record lows in March, with the volume of sales at clothing and footwear stores down a whopping 34.8% on the previous month.