The market remained subdued through 2025 with only cautious signs of recovery, as shoppers prioritised convenience, versatility, and trend-led value. As a result, brands that combined strong value perception with trend relevance and clear positioning are set to have gained traction, while those unable to differentiate or justify price points have seen some share erosion.

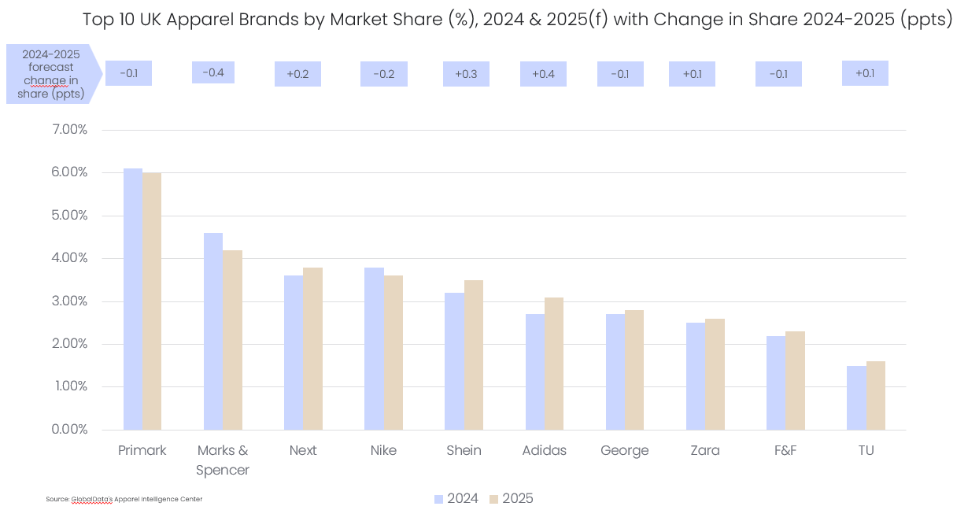

Sharon Iles, senior apparel analyst at GlobalData, comments: “Primark is expected to have remained the UK’s largest apparel brand, though its market share is set to have edged down 0.1ppts to 6.0% in 2025. Similarly, Marks & Spencer experienced a more notable decline of 0.4ppts to 4.2%, affected by a cyber-attack in early 2025, and reflecting an intensified competition across mid-market segments. Within sportswear, Nike is expected to have lost 0.2ppts to 3.6%, due to a lag in innovation and weaker style credentials.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“In contrast, several brands are forecast to have gained share. Next rose 0.2ppts to 3.8%, supported by its broad brand offering and multi-channel strength. Shein is set to have further increased its share by 0.3ppts to 3.5%, continuing to capitalise on low prices and rapid trend turnaround. Adidas is also set to have been among the stronger performers, with a share growth of 0.4ppts to 3.1%, benefiting from sustained demand for its Original lines and performance footwear.

Iles continues: “Within the mass market segment, Zara is set to have posted a modest 0.1ppts uplift to 2.6%, as the brand continued to leverage its style credentials but started to reach maturity in some European markets. Supermarket players George, F&F and TU are all set to gain 0.1ppts in share to 2.8%, 2.3% and 1.6% respectively, as they improved their fashion credentials while maintaining low prices—an approach that resonated with shoppers amid 2025’s economic turbulence.”