Yesterday (19 Feb), eBay announced it was acquiring Depop from Etsy in a $1.2bn deal.

eBay is a key destination for UK shoppers, with 43% of secondhand shoppers buying from it in February, versus 35% for Vinted.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

But Aliyah Siddika, associate Analyst at GlobalData, says this gap is narrowing fast.

“Buying Depop is as much about defence as it is about growth. eBay is shoring up its fashion credentials before Vinted becomes the default.”

“Depop’s value to eBay is not its current scale but its audience: it skews younger, and these consumers are disproportionately driving resale. Bringing younger shoppers into eBay’s broader ecosystem could lift engagement beyond apparel.”

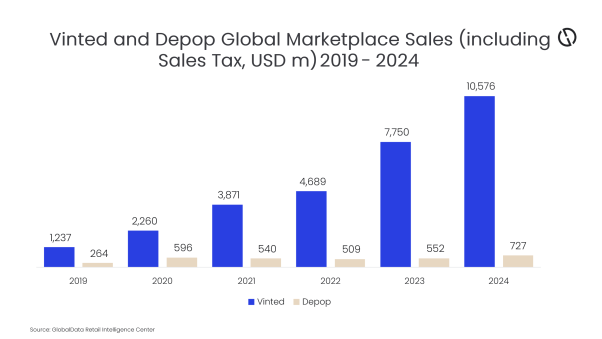

However, the gap versus Vinted is stark. Vinted’s global marketplace sales rose from $1,237m in 2019 to $10,576m in 2024, while Depop grew from $264m to $727m.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDepop has done better in recent years and has pointed to roughly $1bn of marketplace sales in 2025, but this still makes it a tenth of the size of Vinted.

Depop’s 10% seller fee (removed only in 2024) was a significant hindrance to progress as Vinted normalised fee-free selling. The additional cost to sellers left Depop increasingly oriented toward vintage and premium resellers rather than the everyday bargain-hunters who drive the highest volumes.

“While Depop will remain a standalone platform, eBay’s real opportunity is to improve the parts of the experience where Depop has struggled to keep pace,” says Siddika.

“Strengthening authenticity guarantees, shipping and cross-border trade, and payments and financial services should raise trust and reduce friction. These are areas where eBay has long-established operational expertise. However, eBay must look beyond fixing Depop’s challenges; the greatest strategic benefit will come from using Depop to amplify eBay’s own clothing & footwear offer, creating a more connected ecosystem between the two platforms. Done well, Depop can act as a culturally relevant entry point for younger shoppers, while eBay can broaden those users’ engagement into other secondhand categories.”