Tough economic conditions and consumers’ discerning shopping habits will continue to cause significant disparity in the performance of apparel brands in 2025.

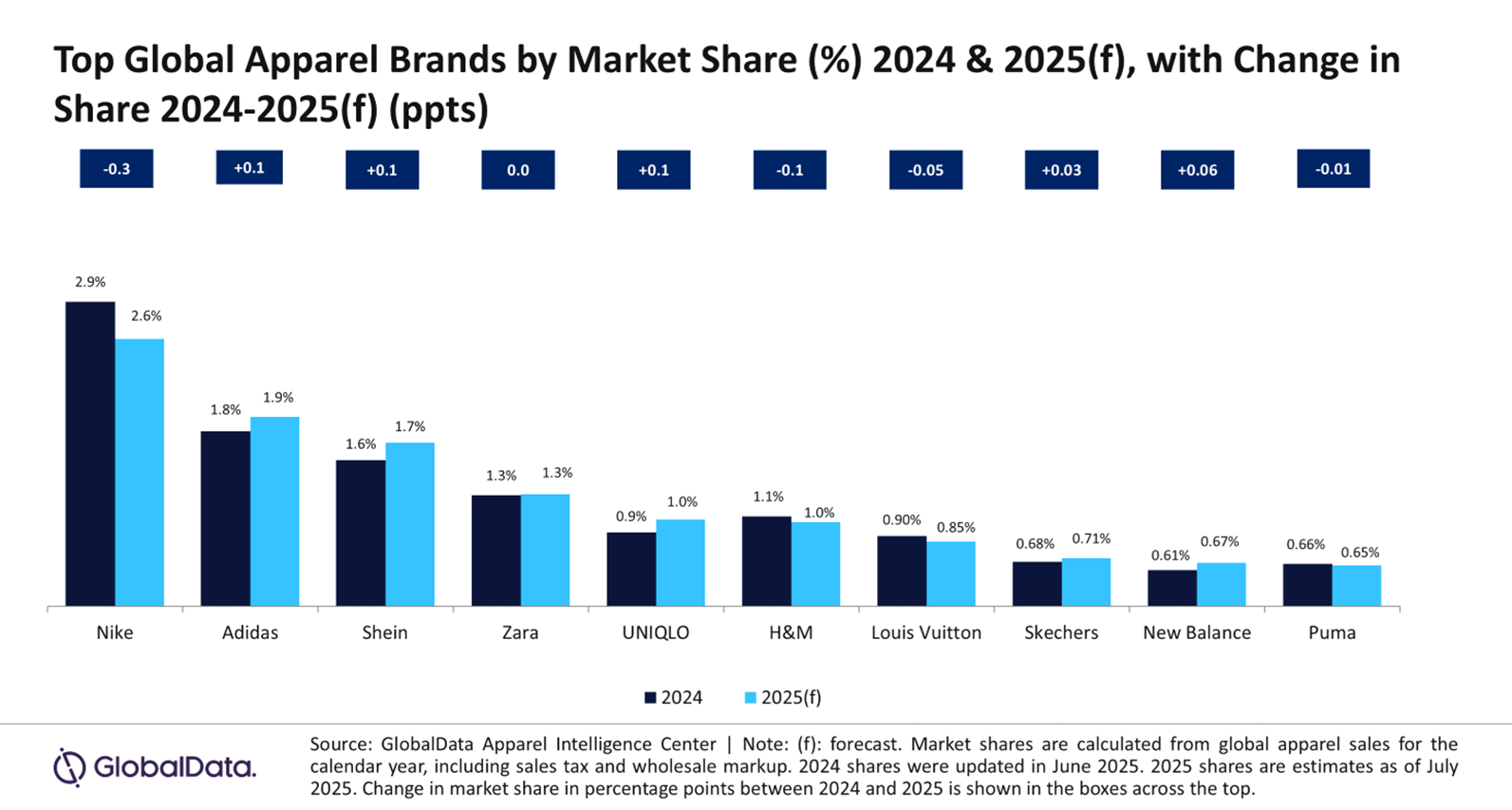

Tom Ljubojevic, apparel analyst at GlobalData, said: “Brands that can quickly react to trends and offer good value for money will have the opportunity to gain share, whereas those that are unable to compete on price or style are forecast to lose out. Adidas’ market share is estimated to rise by 0.1 percentage points (ppts) to 1.9% in 2025, driven by the continued popularity of its Originals lines and the success of its performance footwear. Elsewhere within sportswear, New Balance and Skechers are also expected to gain share, bolstered by their versatility, alongside their high-profile athlete and brand partnerships.”

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Ljubojevic continued: “These sportswear players will continue to take share from Nike, which is forecast to see the biggest drop overall, falling 0.3ppts to 2.6%. A combination of a lag in innovation, and weaker style credentials have caused this decline. Although the recent delay of NikeSKIMS will not help the brands’ situation, it is now focusing on its performance categories, and its athlete strategy to help it return to growth.”

Shein is also expected to continue gaining significant share in 2025, further building on its success from the last few years. Its market share is forecast to grow 0.1ppts to 1.7%. While the company’s growth is now slowing due to its established presence, its low-cost products and ability to capitalise quickly on trends helps it to keep stealing share from competitors.

“In terms of the other mass market fashion brands, Uniqlo is also predicted to win big this year, with its market share forecast to rise 0.1ppts to 1.0%, as its timeless designs and good quality products resonate with consumers seeking value for money,” said Ljubojevic. Conversely, its high street competitors, Zara and H&M, are expected to slow, with Zara to maintain flat market share, and H&M falling 0.1ppts to 1.0%. Both brands have been unable to compete on price with Shein, and while Zara is expected to maintain share through its superior fashion credentials, H&M’s lackluster designs will continue to hold it back.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData