Cardlytics’ ‘State of Spend: Golden Quarter 2025’ report forecasts that the 2025 Golden Quarter will be defined by early action, tighter planning and more selective spending across gifting, fashion and grocery.

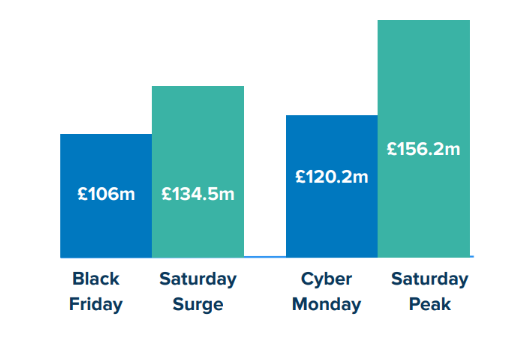

The major behavioural shifts include shoppers moving away from single-day events, with only 11% stating they shop primarily on Black Friday or Cyber Monday, as spending on surrounding weekends is now significantly higher. Nearly a third (30%) will complete their festive shopping before Black Friday even begins.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Credit: Cardlytics

Gifting is getting more selective, as over half (53%) of consumers will choose something personal or practical and just 11% plan to give luxury gifts with luxury department stores losing relevance.

With brands, this shift presents both a challenge and an opportunity. Shoppers are not disengaging, “they are simply shopping with clearer intent,” says the report.

Fashion enters a reset

Fashion remains a core category for the festive season, but growth is no longer universal. While online fast fashion remains well ahead of 2022 levels, growth has slowed sharply – from +22.7% in 2023 to +14.7% in 2024. High street fashion grew just 3.6% last year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataLuxury and designer fashion fell 18.7% last year, leaving the category more than 11% below 2022 levels – a further blow to the sector struggling with customer retention amid cost constraints.

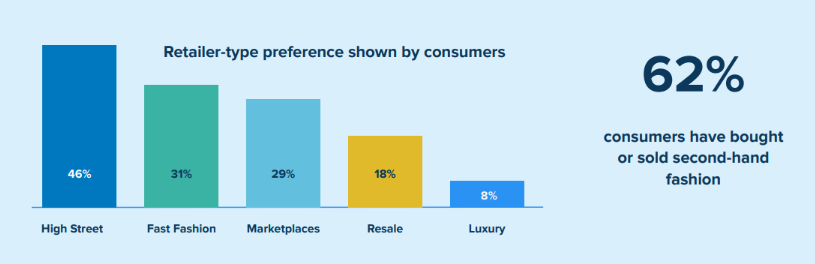

Credit: Cardlytics

Meanwhile, marketplaces and resale platforms are gaining ground. Nearly a third of shoppers say they will use marketplaces for fashion this season, and 18% plan to shop second-hand, while only 8% will buy luxury or designer gifts.

More than 60% of consumers say they have either bought, sold, or would consider resale – signalling that resale is now a mainstream part of how people shop.

Cardlytics suggests loyalty in fashion is waning. Consumers are frequently mixing price points, platforms and formats; and are increasingly driven by value, sustainability and ease, rather than by trend or habit.

The platform says the post-pandemic fashion boom has fragmented with fast fashion cooling, luxury declining and marketplaces taking share.

The report’s advice to fashion brands is to meet shoppers across platforms and price points, rather than expecting habitual return.