Shares in Moss Bros Group tumbled more than 18% this morning (10 January) after the men’s wear retailer issued a profit warning following a “significant reduction” in footfall during the crucial December trading period.

In its trading update for the 23 weeks to 6 January, the company cited “a very challenging consumer backdrop” and revised its full-year pre-tax profit expectations.

Total sales for the period were 1.1% ahead of last year, while total retail sales, including e-commerce, were up 1.6% on the same period last year.

Meanwhile, like-for-like total sales for the first 23 weeks of the second half were 0.1% lower than last year. On a like for like basis, retail sales including e-commerce were up 0.4% in the period under review. E-commerce sales rose 12.3% on last year and accounted for just under 13% of group revenue.

Overall, gross margins fell by 3% on last year, with Moss Bros noting its tightly controlled buy levels for the autumn/winter season meant the deepest level markdowns were avoided.

Expecting these “challenging retail conditions to continue for the foreseeable future,” the company now sees full-year pre-tax profit of between GBP6.5m and GBP6.8m (US$8.8m-$9.2m), which is “slightly below” current market expectations.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOn top of reduced store footfall and a harder competitive environment, CEO Brian Brick said strong cost headwinds and a desire to protect margins, “led to a disappointing year-end shortfall to sales and subsequently to our anticipated profits for the full year. This is all the more frustrating given that we have continued to make progress with like-for-like retail and online sales and with our hire proposition.”

Sofie Willmott, senior retail analyst at GlobalData, notes a decent online sales lift was not enough to bolster the retailer’s overall performance.

“Though the nature of its product and the importance of fit will mean the retailer naturally has a lower online penetration than other clothing and footwear players, Moss Bros must continue to invest in order to capitalise on shopper demand shifting to digital channels, for example, by using personalisation to drive repeat purchases,” she adds.

“Online pureplays such as Asos and boohooman.com are hot on its heels, focused on growing their suiting offer and Moss Bros cannot stand still or else it will be left behind, with the younger customer base it is targeting unaware of its presence.”

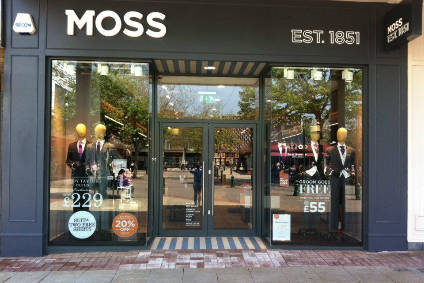

However, Willmott notes the retailer’s physical locations still drive the majority of retail spend, and that its store revamp strategy will give it an advantage over its mid-market rivals such as Next, Debenhams and Marks & Spencer.