The survey, collected by the BRC from 7–10 October 2025, shows that personal spending on retail climbed to +14 in October, up from +5 in September, while overall spending rose to +18, compared with +14 the month before.

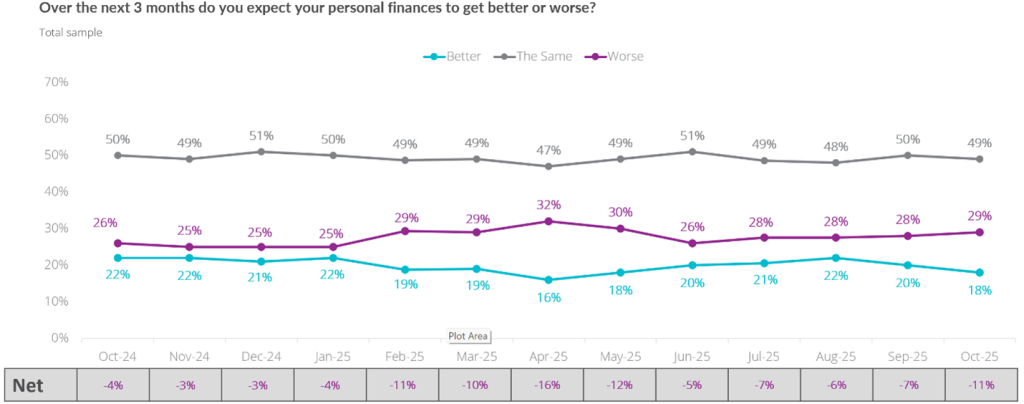

At the same time, personal saving fell to -9, down from 0 in September, and sentiment on personal finances dropped to -11, the first double-digit fall since May.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Consumer expectations for their personal financial situation over the next three months. Credit: BRC

British Retail Consortium chief executive Helen Dickinson said: “With Christmas now around the corner, expectations of spending, particularly on retail goods, rose sharply, with a corresponding drop in expected savings.

“This effect was pronounced among Millennials and Gen X, the generations most likely to have children living at home. Worries about the cost of Christmas, coupled with concerns about potential tax rises in the upcoming Budget are likely to have contributed to the drop in sentiment around personal finances, which fell into double digits for the first time since May.”

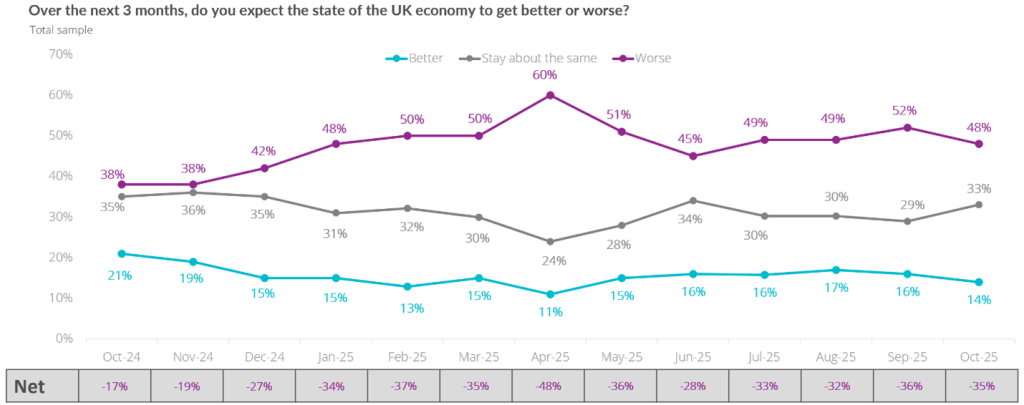

Consumer expectations for the state of the economy over the next three months. Credit: BRC

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhile confidence in the wider economy improved slightly to -35 in October from -36 in September, households appear increasingly focused on managing day-to-day costs while planning seasonal spending.

Dickinson highlighted the upcoming UK Budget, which is due to be announced on 26 November, could be a chance to relieve some of the cost pressures, particularly the burden of business rates on the retail sector.