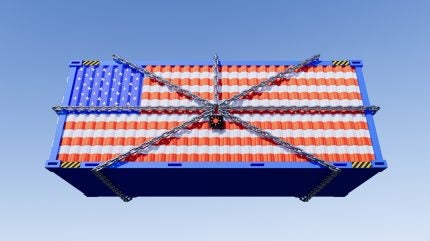

The US House Ways & Means Committee, the chief tax-writing committee in the House of Representatives, included a provision in the budget reconciliation bill that would eliminate de minimis entry privilege for commercial shipments permanently.

According to Section 321 of the Tariff Act of 1930, shipments destined for businesses and consumers in the US with a value below $800 are permitted entry into the country without being subjected to duties and taxes.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The provision was terminated for goods from China, including Hong Kong and Macau, as of 2 May, but it remains applicable to imports from other nations.

The latest provision “repeals the de minimis privilege worldwide” effective 1 July 2027. It added that “this section also increases penalties for violators of Section 321 of the Tariff Act of 1930”.

NCTO president and CEO Kim Glas said: “On behalf of the US textile industry, we would like to commend the House Ways and Means Committee for including an important and critical provision in the broader budget reconciliation bill that would permanently end de minimis access for commercial shipments from all countries, effective 1 July 2027.

“The committee is slated to consider and mark up this legislation today. This significant step by chairman Jason Smith (R-MO), Rep. Greg Murphy (R-NC), and the entire committee validates that the destructive de minimis loophole has harmed US textile manufacturing and impeded the fight against illicit fentanyl trafficking and must be permanently closed.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataData from US customs revealed a surge in de minimis exemption use by over 600%, climbing from around 139m shipments in fiscal year 2015 to over 1bn annually in 2023. In 2024, shipments entering under de minimis reached 1.36bn.

The proposed legislation maintains lower de minimis levels for gifts and personal items brought into the US.

Additionally, it introduces penalties for misuse of de minimis before this deadline to import goods in violation of US laws, setting fines at $5,000 for initial infractions and $10,000 for subsequent ones.

Glas added: “As the bill makes its way through the legislative process, we strongly support a more aggressive timeline to implement a permanent ban on de minimis globally given its significant harm to manufacturers, retailers, and the fight against fentanyl and other illegal products. Express shippers have already transitioned to processing all Chinese imports through sophisticated logistics systems, demonstrating their ability to comply with the president’s executive orders and pivot quickly.

“We recognise the committee’s leadership in moving forward with a permanent global solution that will help restore a level playing field for US manufacturers and spur more investment and job growth.”

Earlier this month (May), NCTO praised the Trump Administration’s termination of de minimis for low-value shipments from China and Hong Kong and called for an extension of this policy to all countries.