In GlobalData’s consumer survey conducted across Germany, France, Spain, Italy, China and the US in December 2023, apparel shoppers showed that they prioritise sustainability and ethics far less than factors like price, quality and value for money, exacerbated by the ongoing economic crisis. However, 60.2% still worry about the industry’s effect on the environment and 62.8% are avoiding buying fast fashion as a result, highlighting how brands and retailers must still focus on the environmental and ethical impact of their practises to maintain strong consumer perceptions.

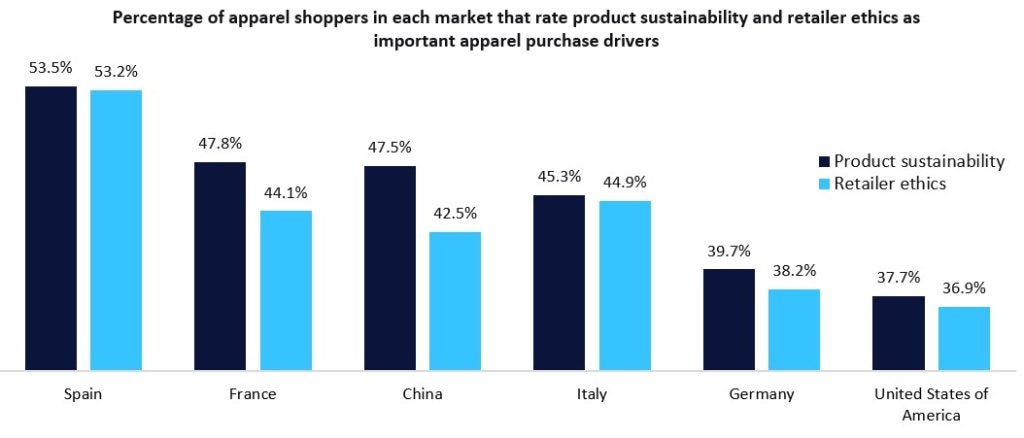

While sustainability and ethics are buzzwords within the fashion industry, when shoppers were asked how often certain factors influence their apparel purchases, these were ranked as the least influential, with just 45.4% and 43.5% of respondents stating that they always or often impact their decisions, respectively, across the six countries combined. Spanish apparel shoppers prioritise these factors the most, with the country’s hot climate and outdoor lifestyle bolstering their awareness of climate change, and in turn, the negative impacts of the fashion industry. In contrast, US apparel shoppers consider these factors the least, supporting the strong growth of fast fashion brands like Shein and Fashion Nova in the country. Overall, females say that they consider the environmental and ethical impact of their purchases more than males, which despite seeming contradictory as they also have a greater tendency to buy from fast fashion brands, indicates that they try to offset some of this guilt within their other purchases, while also potentially having greater awareness of fashion’s harmful effects. The younger age groups also consider them more strongly, driving these factors to become more influential in the future as they age.

Source: GlobalData’s consumer survey across Spain, Germany, France, Italy, US and China, conducted in December 2023. Responses are from shoppers that had purchased apparel in the last 12 months. The figures show the percentage that said sustainability and ethics always or often influence their apparel purchases.

Despite apparel shoppers’ deprioritisation of sustainability and ethics, 60.2% across all surveyed countries stated that they worry about the impact fashion has on the environment, though for many consumers, this is outweighed by features like price, quality and fit. 67.1% of respondents stated that they try to purchase from more sustainable brands or ranges, but again, their efforts may be dampened by other factors at play, and they may also feel they struggle to find appropriate eco-friendly brands. Consumers in Spain, again, try to shop sustainably the most, and US shoppers the least, though there was less disparity between the two genders, with males’ focus on essentials and classic pieces helping to aid the appeal of slow fashion. These views are also driving shoppers to turn away from fast fashion, with 62.8% agreeing that they avoid buying from these types of brands. This saw the strongest agreement among shoppers in China, with fast fashion players like H&M and Zara facing boycotts there due to their alleged links to Uyghur forced labour, while fast-growing players like Shein and Cider do not have a presence in the country, and Chinese shoppers also have the greatest affinity for luxury goods. As expected, more males agreed than females, while responses were relatively consistent across the ages, which is surprising considering young shoppers are highly engaged with fast fashion due to its affordability and their desire to keep up with trends.

When apparel shoppers were asked which sustainable actions they have taken in the past year, donating items to a charity or thrift shop was the most common, with 41.3% doing this, and it was most popular among those in the US, as cited by 55.7%, which is unsurprising with the large number of thrift shops in the country. This was followed by selling and buying secondhand, done by 27.1% and 26.2%, respectively. Buying secondhand apparel was most popular among shoppers in the US and France, with 34.1% of respondents doing this in both countries, and is more driven by consumers trying to save money rather than to be sustainable, with GlobalData predicting that the global apparel resale market will grow by 14.2% to $219.9bn in 2024, with a CAGR of 11.8% between 2023 and 2027. 13.1% of shoppers also stated that they had used a brand or retailer’s recycling scheme, while 8.7% had used a repair scheme and 8.2% had rented apparel, with the former two actions most popular among shoppers in China as their preference for luxury goods drives them to try and extend product lifespans.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData