From Vietnam to Bangladesh, garment factories in many leading apparel-exporting countries recently reported a slowdown in sourcing orders. Is another recession coming, or are we on the brink of a recovery?

This article analyses the latest trade data from the Office of Textiles and Apparel (OTEXA) and other government sources, hoping to shed some light on the evolving US apparel sourcing trends in the first two months of 2023.

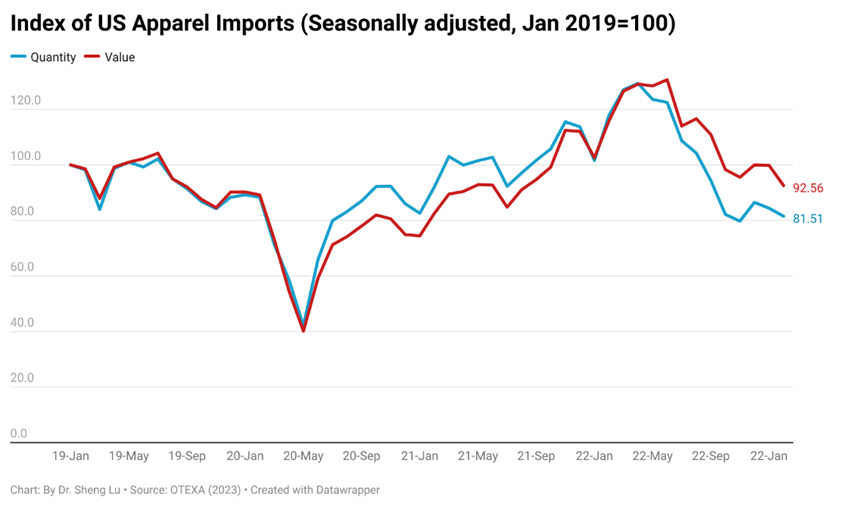

First, US apparel imports have hit a new low amid the weakened economy. Specifically, in the first two months of 2023, US apparel imports decreased by 24.4% in quantity and 11.9% in value year over year. Seasonally adjusted data also shows that US apparel imports in February 2023 dropped by 3.4% in volume and 7% in value from January 2023. Nationwide, total US merchandise imports fell by 2.2% in February 2023 year over year, reflecting slowed economic growth and consumers’ reduced enthusiasm for purchasing goods.

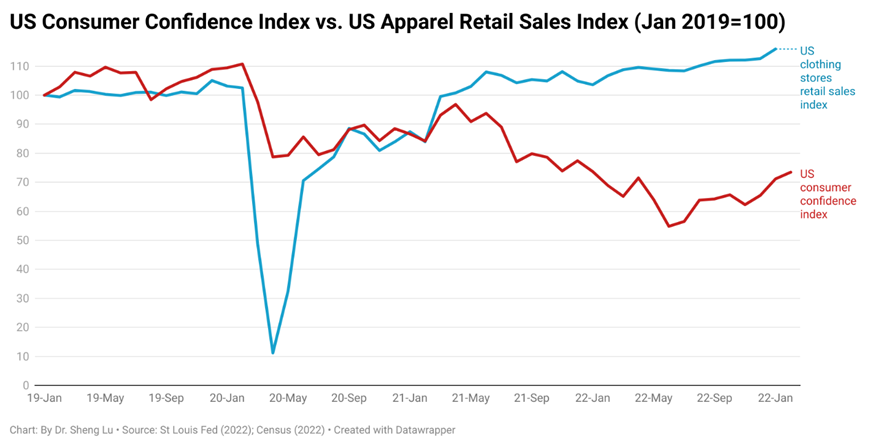

Nevertheless, despite the import decline, the consumer confidence index (CCI), a critical measurement of households’ financial outlook, climbed to 73.5 in February 2023 (January 2019=100), and reached its highest level in the most recent six months. Similarly, the seasonally adjusted US clothing stores’ retail sales index, measuring consumers’ clothing expenditures, remained relatively stable at around 116 in 2023 (January 2019=100).

Given all the positive and negative factors and considering the uncertainties in the US economy, we might see US apparel imports stay relatively flat in the next few months before a gradual recovery starting from the year’s second half.

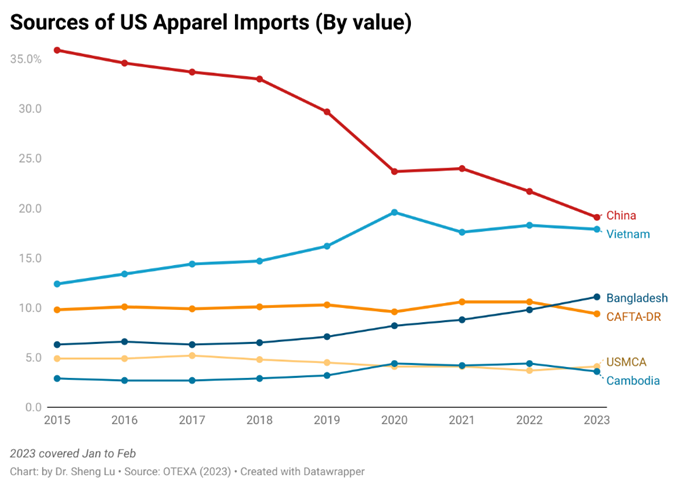

Second, US apparel imports from China fell sharply as fashion companies’ “reducing China exposure” strategies continued. Specifically, US apparel imports from China plummeted by 35.5% in quantity and 29.7% in value, much worse than the world average. Notably, despite China’s relaxation of its strict zero-COVID policy in late 2022, there has been no noticeable improvement in US fashion companies’ confidence in sourcing from China. Instead, as tensions continue to rise between the US and China, coupled with growing geopolitical concerns, many US companies are accelerating the pace of relocating their sourcing orders out of China, particularly those that do not cater to the domestic Chinese market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOn the other hand, US fashion companies are also shifting the types of products they import from China. For example, US apparel imports from China have become ever more diverse in product categories. Notably, China’s Herfindahl–Hirschman index (HHI) calculated based on the 6-digit HS code in Chapters 61 and 62 decreased from 2.17 in 2022 to only 1.93 in the first two months of 2023. Analysis of some US fashion companies’ supplier lists shows that their contracted garment factories in China were comparatively smaller than those in other Asian countries. In other words, US companies increasingly treat China as an apparel sourcing base for flexibility and agility, particularly those orders that include a greater variety of products in relatively smaller quantities.

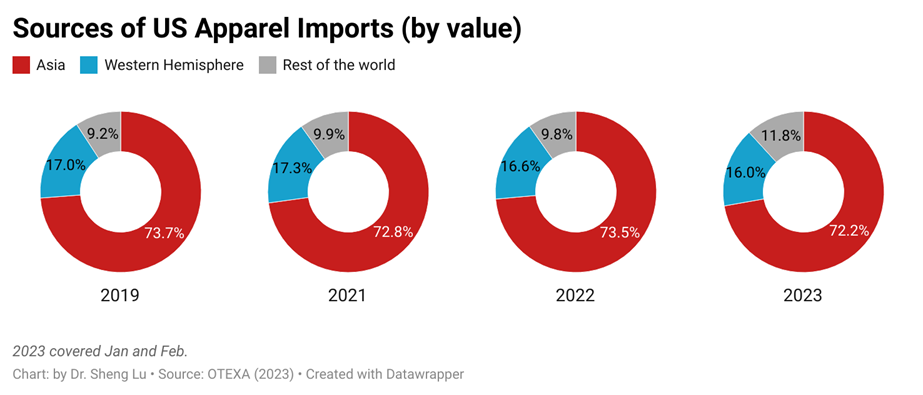

Third, Asian countries as a whole continue to be the primary sourcing destination for US fashion companies. Specifically, in the first two months of 2023, about 72.2% of US apparel imports came from Asian countries, a pattern that has stayed stable over the past decade. Meanwhile, Asian countries, particularly those with relatively large production scales, seem to benefit the most from US fashion companies’ “reducing China exposure” strategy. For example, in the first two months of 2023, Bangladesh (up 1.5 percentage points), India (up 0.8 percentage points), Indonesia (up 0.3 percentage points), and Vietnam (up 0.2 percentage points) all experienced an increase in market share as compared to the previous year.

Meanwhile, US fashion companies are also broadening the range of products they source from Asian countries beyond China. For example, industry-level data indicate that US apparel imports from Vietnam, Bangladesh, India, Indonesia, and Cambodia (Asia5) collectively were already as diverse as those from China as of 2022. Also, US fashion companies were much more likely to import cotton apparel from Asia than China due to the Uyghur Forced Labor Prevention Act (UFLPA) implemented in June 2022. In other words, these Asian countries are increasingly becoming viable alternatives to China for sourcing.

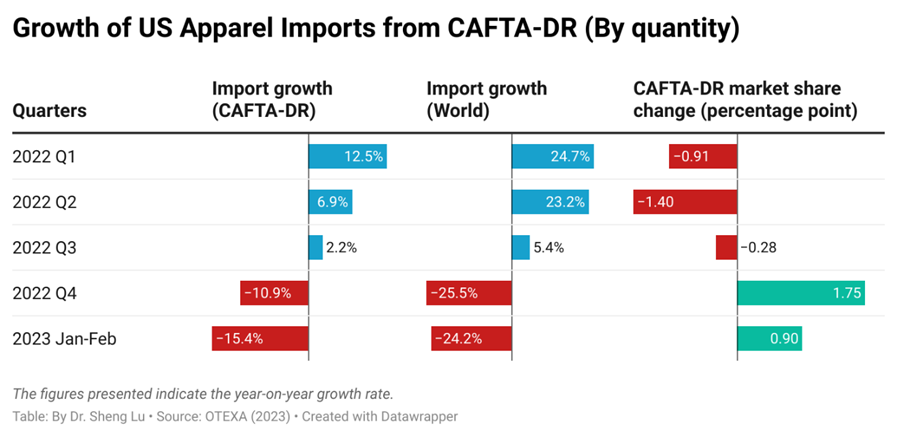

Fourth, near-shoring from the Western Hemisphere is promising but critical bottlenecks remain to be addressed. At first glance, US apparel imports from the Western Hemisphere gained additional market shares in the first two months of 2023 (up from 11.9% to 13.5% in quantity), including from members of the Dominican Republic-Central America Free Trade Agreement, CAFTA-DR (up from 7.8% to 8.7% in quantity).

Although the results are encouraging, it’s important to interpret them in the context of the specific products US companies are sourcing from the region. For instance, most US apparel imports from CAFTA-DR members consist of basic fashion items such as T-shirts and bottoms, which are considered essential categories and may be more resistant to economic downturns. In comparison, US fashion companies typically source a broader range of apparel products, including discretionary categories, from Asia.

As a result, US apparel imports from many Asian countries suffered a more significant decline during the recent economic slowdown. In other words, it remains a question whether US fashion companies are moving sourcing orders from Asia to the Western Hemisphere or instead leveraging near-shoring as part of their sourcing diversification strategies. On the other hand, a more effective long-term strategy for expanding US apparel sourcing from the Western Hemisphere is to diversify the product offerings and enable garment factories in the region to access necessary textile materials more easily and at a lower cost.