The ‘Global Children’s Market to 2028‘ report reveals the global childrenswear market experienced a modest growth of 3.5% in 2023 with a 2.7% increase in global volumes and declines in Western Europe and North America

Economic challenges are expected to persist in 2024 with growth forecast at just 1.2%. However, an uptick in growth is anticipated from 2025 as inflation stabilises and consumer confidence returns.

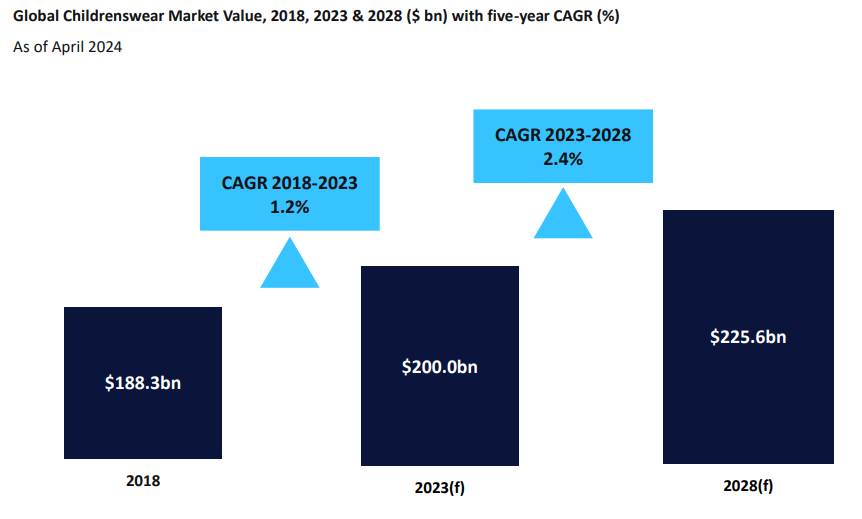

The childrenswear market is projected to grow at a slower pace with a compound annual growth rate (CAGR) of 2.4% to reach $225.6bn between 2023 and 2028 which is slower than womenswear and menswear, due to declining birth rates.

Global childrenswear market drivers

- Shorter lifecycles: The necessity for frequent replacement within the childrenswear market, due to children quickly outgrowing or damaging garments, will support growth during tough economic times. Purchases are more often viewed as more essential than for menswear and womenswear, and parents will prioritise purchases for their children over themselves.

- New brands entering the market: Brands such as Phase Eight and Represent, which previously specialised in adult clothing have introduced childrenswear ranges for the first time. The retailers recognised the resilience of the sector during the pandemic and see it as a way to diversify their offer and attract a broader consumer base.

- Asia Pacific: Asia Pacific will be the fastest-growing region within the global childrenswear market, achieving a forecast CAGR of 4.2% between 2023 and 2028. This is thanks to the region’s burgeoning economies and rising disposable incomes, particularly in emerging countries like India and the Philippines, as well as the growth of the online channel.

- Social media: Social media continues to inspire and encourage childrenswear purchases, notably through the “mini-me” trend where parents dress their children in styles that mirror their own, as well as the rise of child influencers. These famous figures will help to increase children’s awareness and interest in fashion, and brands will increasingly collaborate with them to extend their reach.

Childrenswear growth in 2018, 2023 and 2028

GlobalData’s report indicates that although growth is expected to accelerate in the coming years as inflationary pressures ease, the demand for childrenswear will continue to be affected by shrinking family sizes.

Despite the challenges posed by the pandemic, the global childrenswear market demonstrated greater resilience compared to menswear and womenswear, primarily due to its essential nature. The necessity for more frequent replacements, driven by children’s growth spurts and wear and tear contributed to this resilience.

However, growth slowed to 1.7% in 2022, attributed in part to weak exchange rates, particularly evident in Europe with its Euro where there was a growth rate of 14.2%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn 2023, growth further decelerated to 3.5% in US dollars and 0.9% in Euros, as families grappled with high inflation. Global volumes saw a marginal increase of only 2.7%, with declines observed in North America and Western Europe, where consumers reduced spending amid economic uncertainties and declining birth rates.

The forecast for 2024 indicates a continued slowdown, with projected growth of just 1.2% in dollars, driven by persistent inflationary pressures. Over the period from 2023 to 2028, the market is anticipated to grow at a CAGR of 2.4%, trailing behind womenswear and menswear growth rates, primarily due to the impact of declining birth rates on the child population.

Primark deemed childrenswear market winner

Associated British Foods’ budget retailer Primark was the biggest apparel brand in the UK in 2023, according to GlobalData, with industry experts crediting its trend-led fashion offerings and affordable prices.

Primark is also praised for its ongoing success in the childrenswear market with a 0.3 percentage point (ppt) increase in market share from 2021 to 2023. This growth is attributed to its global expansion, affordable and on-trend ranges, and strong franchise collaborations. Similarly, Zara is making gains by appealing to fashion-forward parents.

Despite maintaining its market leader position, Swedish retailer H&M has experienced a 0.2ppts decline in share, facing competition from fast-fashion giant Shein as well as Primark, which are said to offer “more exciting” products at better prices. US players Old Navy, Carter’s, and The Children’s Place continue to struggle amid challenging economic conditions and are failing to entice shoppers with their offerings.

While sports giant Nike remains resilient to inflation, Adidas has seen its share contract by 0.2ppts between 2021 and 2023 due to a lack of innovation and less fashionable products than its competitors.