Canadian luxury outerwear maker Canada Goose has become the latest fashion brand to acquire one of its suppliers, as it looks to create new and expand existing categories and assume greater control over its supply chain.

Canada Goose announced the acquisition of the operating assets of its Romanian supply partner, Paola Confectii, which has supplied knitwear to Canada Goose since its launch in 2017.

Inside the deal

Paola Confectii has been producing a range of best-selling styles for Canada Goose including the HyBridge Knit Jacket.

Canada Goose says knitwear is one of the leading segments of its growing apparel category, exceeding $70m in annual sales in fiscal 2023.

“This closer partnership is expected to enhance product margins and supply control, while deepening in-house product expertise. Paola Confectii will continue to be led by Giannino Lessi, general manager, and Paola Zaffalon, Technical Director, as a standalone entity, maintaining regular operations.

“Our vertically integrated supply chain has always been one of our core competencies. This strategic investment advances our renowned manufacturing infrastructure and validates the performance luxury brand we are today,” explained Dani Reiss, chairman and CEO, Canada Goose. “It also demonstrates the confidence we have in our emerging categories and our plans to develop these categories into even more meaningful contributors to our business.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhile the core down-filled products will continue to be manufactured in Canada, apparel production will be concentrated within the company’s European facilities.

“As we’ve evolved and introduced new categories, we’ve strategically welcomed new world-class partners from different parts of the globe who share our values and commitment to craftsmanship,” Canada Goose said.

Why the deal matters

Speaking to Just Style, Alice Price, apparel analyst at GlobalData, commented: “Canada Goose’s acquisition of a European manufacturing facility sets it on firm ground to achieve its growth plan, enabling it to scale up its product assortment beyond outerwear and standout as a lifestyle brand for all seasons.”

This is not the first time we have seen a major fashion player acquire one of its suppliers. In fact, it has become something of a trend, particularly in the luxury fashion sector, over the last few years.

The heads of both businesses said the acquisition represents a shared interest: “assuring continuity, preserving know-how, creating value for the ‘Made in Italy’ in the name of craftsmanship and innovation.”

Then, in 2022, footwear brand Golden Goose acquired its largest supplier, the Italian Fashion Team.

Advisor on the deal, Clearwater International, said that as IFT is Golden Goose’s top supplier, the acquisition is a strategic step in the name of responsible growth towards the vertical integration of the supply chain.

Earlier this year, British luxury brand, Burberry, acquired Italian outerwear manufacturer Pattern SpA in a EUR21m deal, having partnered with the supplier for over two decades.

The investment means Burberry can secure capacity, build technical outerwear capability and further embed sustainability into its value chain.

Jonathan Akeroyd, CEO, commented that the strategic investment is an important next step in bringing its outerwear category to full potential and it would enhance its capabilities, building on our strong foundations in the UK, and providing greater control over the quality, delivery and sustainability of its products.

Neil Saunders, analyst at GlobalData noted: “Buying one of its manufacturing facilities gives Canada Goose greater control over the supply chain both for existing products and in terms of new innovations they may want to work on in future.”

As Canada Goose is focused on producing high-quality products, this integration makes sense, Saunders explained, noting that ultimately, owning manufacturing will also help improve margins over time.

Saunders added: “Given that Canada Goose already owns various facilities, they already understand the ins and outs of running manufacturing operations. As such, the latest acquisition should be relatively seamless in terms of integration. The only downside comes if Canada Goose wants to move out of knitwear or has pressures in that part of the business; then it has a factory that may not be operating at full capacity. However, as it has been a very fast growing category for the brand I don’t see this as likely.”

Key takeaways for the fashion industry

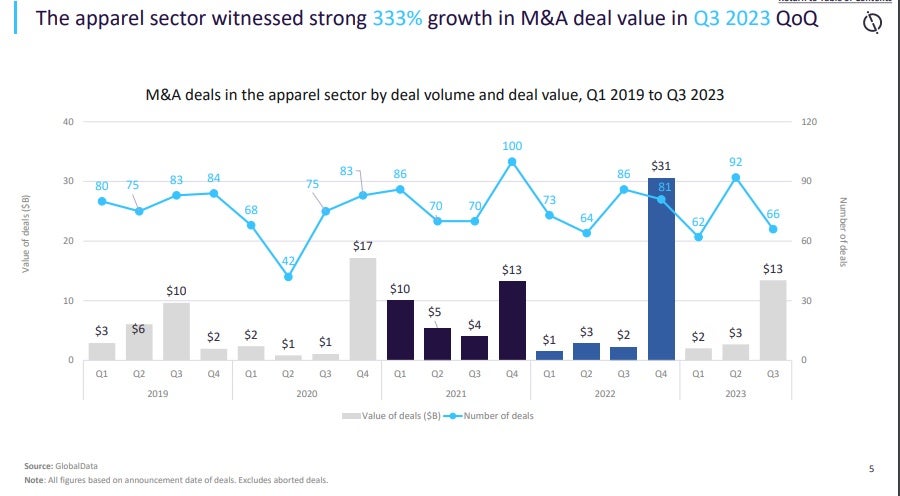

Acquisitive activity is unlikely to die down throughout 2024 in the apparel sector. According to the latest data from GlobalData, in the third quarter of 2023, apparel M&A deal value rose 550% on a year-on-year basis and 333% on a quarter on quarter basis.

Ecommerce was the top theme driving apparel M&A activity in the quarter, with 7 deals worth over $5bn.

When it comes to fashion brands acquiring suppliers, Saunders says this is something we are more likely to see at the more premium end of the fashion spectrum, and perhaps less when it comes to mainstream fashion.

Ultimately, it comes down to higher-end fashion players looking to control supply chains more effectively while improving margins.

Of course, there is an element of supply chain transparency at play here too.

With incoming legislations in the US and EU that require brands to take accountability of how their products were made, by who and whether the people within the supply chain have been treated and compensated fairly and that environmental damage of the production of their goods has been considered, brands are more concerned about the going ons in their supply chains.

Having a supplier that is closer to home turf, or one that is integrated within the organisation itself, makes that visibility a little bit easier.

Saunders notes: “Within mainstream fashion, we might see some acquisition activity but here retailers and brands tend to use third parties because they like the flexibility and simplicity. Some, like Inditex’s Zara, have long been integrated but I expect this will remain the exception rather than the rule.”

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.