Sustainability is struggling to move from beyond talk to measurable action, according to McKinsey & Co’s State of Fashion 2023 report which notes while there is some industry progress, the pace of transformation falls short of what is needed to prepare for impending regulations.

In fact, the report suggests that fossil fuels continue to dominate production while circular business models remain in their infancy, and if progress continues at the current pace, clothing and footwear consumption is expected to increase by over 60%, from 62 million tonnes in 2022 to 102 million tonnes in 2023.

“With the industry struggling to move forward, regulators are stepping in. Leading the charge is the EU as it pursues a vision for a climate-neutral, circular economy, with growth decoupled from the consumption of finite resources,” reads the report.

“The EU’s textiles vision is encapsulated in its Strategy for Sustainable and Circular Textiles, passed in June 2023, which envisages an industry defined by products made with respect for the environment and social rights,” it adds.

As many as 16 pieces of legislation are currently under discussion, with the first coming into force in 2024.

“The window for brands to prepare to comply is narrowing quickly,” the report asserts.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhere should brands focus their attention when it comes to sustainability?

Product design: Up to 80% of a product’s environmental impact is determined in the design phase and is baked into materials and dyes. Once the EU’s flagship Ecodesign for Sustainable Products Regulation (ESPR) comes into full effect in 2025, brands will be expected to adhere to rules around recyclability, durability, reusability, repairability and use of hazardous substances. It’s also very likely brands will be required to offer digital product passports (DPP).

Marketing: Many apparel brands and retailers have been caught out over sustainability claims that have been seen as vague or misleading. Under the EU Green Claims directive which aims to crackdown on greenwashing, brands will be expected to make sustainability claims that are specific, evidence-based, verified and clearly communicated.

Waste management: The report asserts less than 1% of fashion textiles are recycled with many sent to landfill or incinerated. An amendment to the Waste Framework Directive is calling for Extended Producer Responsibility, which already exists in France, and which requires companies to finance the collection, sorting and recycling of textile waste. Fees are expected to vary based on production output and pollution levels caused, a principle known as “eco-modulation.” All EU countries will be required to launch textile collection programmes by 2025 and the destruction of unsold goods is expected to be banned.

Reporting: Companies are still falling short of expectations to provide sufficient data and performance metrics or define economic activities that can be considered sustainable in line with ESG disclosures. A lack of comparability across brands inhibits effective decision-making among investors and consumers. The upcoming Corporate Sustainability Reporting Directive (CSRD) requires companies to report on ESG activities via a standardised framework. Meanwhile, the Corporate Sustainability Due Diligence Directive mandates environmental and human rights diligence and action plans across the value chain.

Traceability: Achieving full supply-chain visibility across all tiers of manufacturing will be a critical enabler for regulatory compliance. However, many brands currently have limited visibility over their suppliers at best, and therefore lack reliable and standardised data to make meaningful progress. Advances in blockchain and other technologies may enable more transparent and efficient clothes in landfill.

Sourcing and production: As upstream supply chain activities account for the majority of carbon emissions in apparel, there may be a sharper focus on decarbonising material and garment production. In the production process, main decarbonisation levers include energy efficiency and energy transition initiatives. As brands shift to more sustainable materials, they may look for new suppliers or join strategic alliances.

Design: New requirements for circularity are expected to shake up the design process. For example, a focus on longevity and durability may demand fresh attention to details such as stitching and seams. Equally, materials that cannot be separated in recycling may need to be avoided, meaning designers may need to think more creatively about design choices. Design libraries may increasingly support material selection, while 3D sampling may reduce use of resources. Packaging design is also impacted, with new rules emerging around composition of labels and tags and elimination of single-use plastics.

End-of-life waste: To minimise production and waste, new business models are coming to the fore. Resale continues to grow through brand partnerships with secondhand marketplaces. In-house programmes offering resale, rental and repair are gaining traction as well. There is also an opportunity to accelerate closed-loop recycling.

Sustainability slowdown

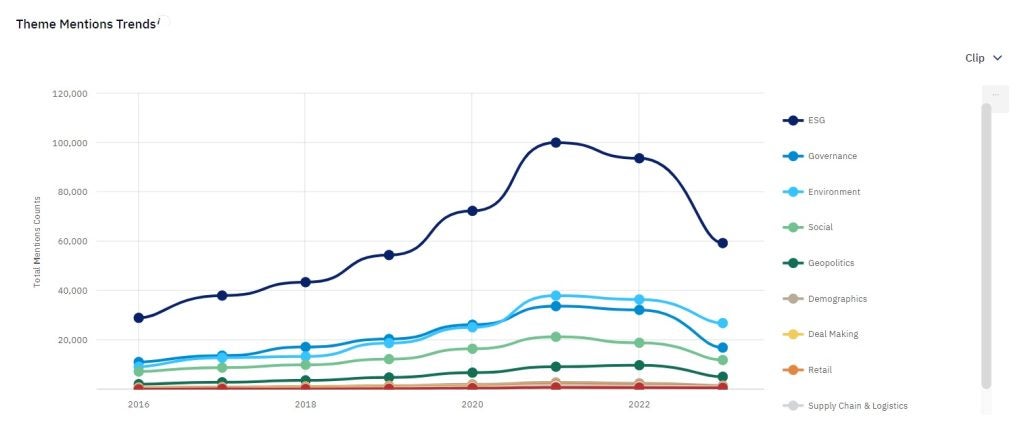

According to GlobalData’s company filing analytics database, the focus around sustainability is flagging, having peaked in 2021.

In 2021, ESG was mentioned 100,113 times in filings, while environment was mentioned 38,065 times. In 2022, ESG was mentioned 93,674 times while environment was mentioned 36,518 times. However, in 2023, both fell sharply with ESG mentioned 59,395 times and environment 26,944 times.

And consumers also appear to be cooling off when it comes to sustainability.

McKinsey’s report urges fashion brands and retailers to get ahead of incoming legislation.

“Regulatory competence is a critical muscle brands need to build and is one that few have today. And given the fundamental challenge regulation poses to some segments, such as fast fashion, procrastination is ill-advised.

“Brands should consider establishing a squad of regulatory experts. This squad can review the laws relevant to the business, conduct materiality assessments and advise on implications for the organisation. However, regulation ultimately cannot be outsourced to a single team. All C-suite executives need to build knowledge, align strategies within the regulatory programme, identify capabilities and tools required for change, and disseminate knowledge across respective departments.

“Additionally, brands should consider viewing regulation as an opportunity rather than a threat. For example, regulation may spur demand for certain materials, creating supply and peaking demand. This could be transformed into a competitive advantage by strategically gaining access to innovative materials in short supply.”

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.