The latest figures from National Retail Federation (NRF) and Hackett Associates’ Global Port Tracker report show import cargo volumes are expected to remain well below last year’s levels heading into autumn.

NRF vice president for supply chain and customs policy, Jonathan Gold, said that consumers are still spending and retail sales are expected to increase this year, but there is not the “explosive demand” seen over the past two years.

Gold explained: “Congestion at the ports has largely gone away as import levels have fallen, but other supply chain challenges remain, ranging from trucker shortages to getting empty containers back to terminals. We were pleased by recent reports of progress related to the West Coast port labour negotiations but will continue to monitor the situation closely until there is a new agreement ratified by both parties.”

“With economic uncertainty continuing, the impact on trade is clear,” Hackett Associates founder Ben Hackett said, noting continued high inflation, Federal Reserve interest rate hikes and recent bank failures. “Year-over-year import volumes have been on the decline at most ports since late last year and declining exports out of China highlight the slowdown in demand for consumer goods. Our forecast now projects a larger decline in imports in the first half of this year than we forecast last month. Our view is that imports will remain below recent levels until inflation rates and inventory surpluses are reduced.”

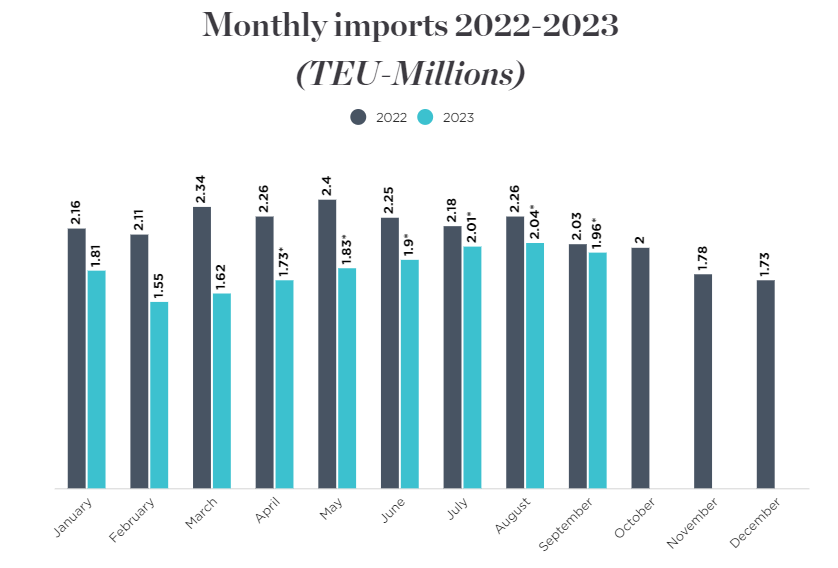

US ports covered by Global Port Tracker handled 1.62 million Twenty-Foot Equivalent Units (TEU) – one 20-foot container or its equivalent – in March, the latest month for which final numbers are available. That was up 5% from February – which saw the lowest levels since May 2020 – but down 30.6% year over year.

Ports have not yet reported April numbers, but Global Port Tracker projected the month at 1.73 million TEU, down 23.4% year over year. Whereas, May is forecast at 1.83 million TEU, down 23.5% from last year’s 2.4 million TEU, which is an all-time record for the number of containers imported during a single month. The large year-over-year declines are skewed by unusually high volumes last year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe first half of 2023 – previously forecast at 10.8 million TEU – is now forecast at 10.4 million TEU, down 22.8% from the first half of 2022. Global Port Tracker has not yet forecast the full year, but the third quarter is expected to total 6 million TEU, down 7.2% from the same time last year, and the first nine months of the year would total 16.5 million TEU, down 17.8% year over year.

Imports for all of 2022 totalled 25.5 million TEU, down 1.2% from the annual record of 25.8 million TEU set in 2021.