Europe’s move to scale back or delay parts of its Green Deal is shifting the dynamics of global sustainability, and Asia Pacific’s manufacturing supply chains could be among the first to feel the impact.

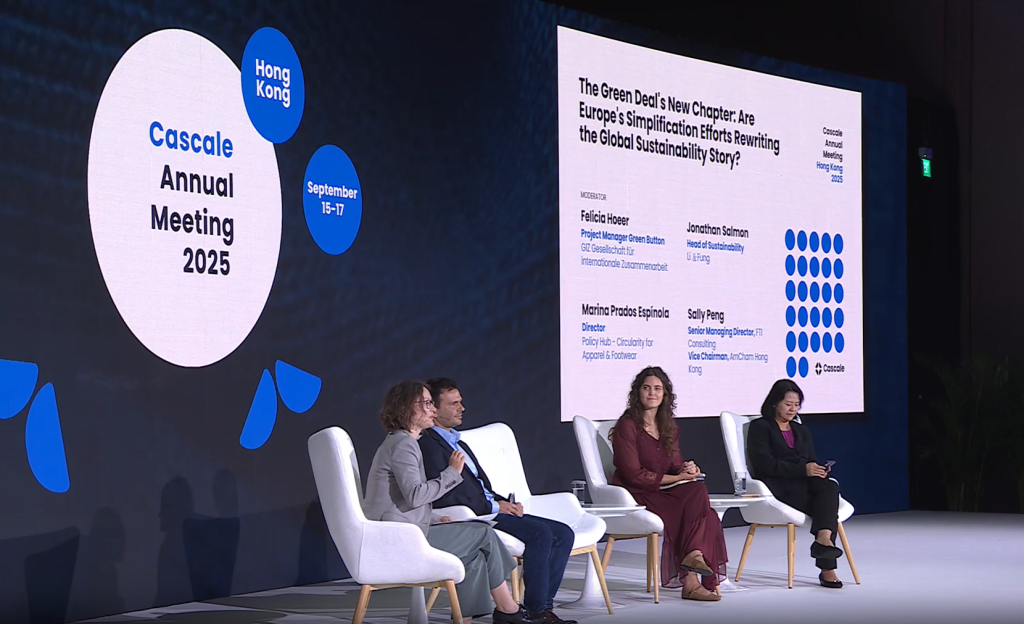

At one of the sessions in Cascale's Annual Meeting in Hong Kong, industry experts explored how regulatory adjustments, including the postponement of the Green Claims Directive and simplifications through the omnibus package, could influence Asia Pacific supply chains.

While the shift signals a more measured pace of change, speakers agreed it doesn’t mark a retreat from sustainability goals, but rather a recalibration.

Ambassador Harvey Rouse, head of the EU Office in Hong Kong and Macau, opened up the dialogue by noting that Europe’s climate commitment remains firm and framed the challenges and opportunities.

“Addressing and fostering sustainability has to be a top priority,” he said. “Furthermore, sustainable businesses will be more resilient to shocks and be more competitive going forward.

“Since 1990, the European Union has cut emissions by 37% while at the same time growing the economy by 68% and that shows that green is not a barrier to growth. It is a driver.”

Rouse emphasised the global nature of sustainability, noting that legislation like corporate sustainable due diligence, traceability rules, and eco-design requirements extend the EU’s reach beyond its borders.

He added: “We’re not going to succeed alone. It's a global problem. We need to work together.”

Eco design standards and digital product passports - both designed to promote traceability and circularity - are emerging as key areas of concern.

Questions from the audience encapsulated how businesses are grappling with understanding how to collect and manage the data these policies require, particularly when working with multiple suppliers and production sites across different countries.

As Marina Prados Espinola, director at the Policy Hub – Circularity for Apparel & Footwear, honestly put it, “We also don’t know.”

She said: "We are receiving some hints on what could be the content of the digital passport, and we are going to have the entire picture by the end of 2027.”

For Asia-Pacific companies, preparing for these rules means understanding their supply chains, improving data availability, and engaging with technology partners.

This understanding will become easier with the passport, as Espinola highlighted, it will serve as “a compliance tool” that centralises information on materials, recycled content, and sustainability credentials.

For Asia Pacific manufacturers supplying European markets, this means the pressure is shifting rather than easing. Companies must still prepare to meet the reporting, traceability, and eco-design requirements that remain central to EU legislation.

Jonathan Salmon, head of sustainability at end-to-end supply chain solutions provider Li & Fung, noted that it’s all about preparation because “regulations at the end of the day will not be a silver bullet to making everything sustainable.”

Salmon went on to say that once we know how to apply these regulations to a business, it will be a way for the industry and consumers to identify performance.

In practice, some encouraging progress is visible, as explained by Sally Peng, senior managing director and vice chairman at FTI Consulting. According to her, Japan is implementing regulations effectively, while Vietnam is catching up quickly, particularly on accessibility.

She added that Hong Kong demonstrates innovation, especially in technology applications within factories and industrial sectors, whilst just across the border in China's Shenzhen, new solutions are emerging that could help regional companies navigate sustainability requirements.

Peng painted a picture of how many APAC clients are balancing competing priorities, with resources diverted to other trade issues. The expectation is that, as uncertainties ease, attention can return to building a coherent global sustainability approach.

The panel offered practical guidance for businesses and policymakers alike. Peng brought forth the need for transparency in policymaking while also pointing to the potential of regional innovation.

“Helping with the negotiation, culminating the data, and then minimising the mitigation, the cost part is one that all together can be mitigated if we bring in more technology partners into the supply chain process,” she said.

Another key recommendation was to actively engage with industry actors beyond the immediate suppliers.

“Listen to the industry and not only the first pieces of the puzzle, not only the vendors, the garment makers, but going beyond the supply chain… In order to be pragmatic, practical and have an impact on footprints, regulations, and performance, we need to work together.

“The success will not happen without the region. It will not happen without the production countries. It will be a collective effort if we want this to make sense.”

Even as Europe refines its Green Deal framework, companies across the supply chain must align their internal systems with EU standards, invest in traceability technology, and participate in voluntary industry initiatives that can prepare them for future compliance.

One thing APAC businesses can take away from the discussion is that sustainability compliance is a strategic imperative, not a one-off exercise.

Early preparation, cross-industry collaboration, and the smart adoption of digital tools will determine which companies can transform regulatory challenges into a competitive advantage.