Each week, Just Style’s journalists analyse data on patent filings and grants that illustrate innovation trends in our sector. These patent signals show where the leading companies are focusing their research and development investment, and why. We uncover key innovation areas in the sector and the themes that drive them.

This new, thematic patents coverage is powered by our underlying Disruptor data which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors.

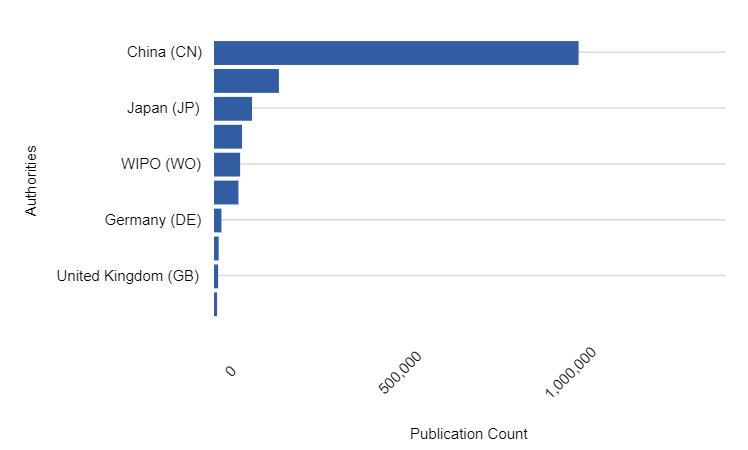

Data compiled by GlobalData reveals China maintained its top spot as the authority on footwear patents between 1 April and 30 June 2023. However, it shows the gap is widening between its closest rival – the United States – from the same period the year before.

Footwear patent publications by location for Q2 2023

Source: GlobalData

The data shows garment and footwear manufacturing behemoth China had 1,066,034 published patents compared to the US’ 187,927, followed by Japan with 109,248 and Europe with 80,077.

Why is the US falling further behind on footwear patents in Q2 2023?

What’s notable however is that the US’ number of footwear patent publications in Q2 2023 had declined compared to the same period in 2022 when it had 199,634 footwear patent publications.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn contrast, China remains the largest apparel and footwear supplier in the world despite talks of diversification and nearshoring. It took the top spot for footwear patent innovation both in Q2 2022 and again in Q2 2023 after it had officially ended its strict zero Covid policy and can benefit from both an international and domestic garment and footwear market.

Plus, The South China Morning Post noted that Shein, as of early-February 2022, was the second most downloaded iOS shopping app in the US and Canada, trailing only e-commerce giant Amazon, quoting data from market intelligence platform Similarweb.