The State of Fashion 2024 report by McKinsey & Co noted the popularity of outdoor activities since the pandemic, and its lasting impact on apparel trends is here to stay.

In a survey conducted for the report, 82% of US consumers said they had participated in outdoor activities such as camping, hiking and boating, up from 60% in 2020. In the UK, nearly half of those surveyed said they were now spending more time outdoors than they did before the pandemic.

In China, searches for ‘outdoor’ on local marketplace Tmall increased more than 600% between 2021 and 2023.

Sportswear and outdoor brands are benefitting from this enduring trend, alongside the popularity of the ‘gorpcore’ style, which has seen younger consumers gravitate towards functional items such as hiking-style trainers and shell jackets.

Gorpcore is said to take its name from a popular term for the trail mix often used to fuel long hikes and runs – or “Good Ol’ Raisins and Peanuts”.

Moving outdoors into the mainstream

The McKinsey report highlights that many of the fastest-growing sports brands in recent years have tapped into this outdoor trend.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn July, The North Face announced its tenth consecutive quarter of double-digit growth. The brand has also collaborated with luxury fashion brand Gucci since 2021, a move that has inspired other outdoor brands such as the Swiss brand On collaborating with luxury brand Loewe and Deckers-owned running brand Hoka working with luxury brand Moncler.

Earlier this year, Deckers Brands reported 35.3% growth in direct-to-consumer net sales, with the company’s running brand Hoka cited as the main reason for its growth. The brand reported a 27.4% surge in net sales, reaching $420.5m.

At the more affordable end of the market, retailers including Swedish fashion brand H&M has also joined the trend, including water-repellent parkas and hiking trousers in its Move collection. Spanish fashion company Inditex has also added hiking boots to its permanent range at Oysho.

In the UK, retailer Marks & Spencer recently added German sportswear brand Adidas and UK athleisure brand Sweaty Betty to its online sportswear platform to broaden its brand offering and tap into the growing sportswear market.

Next year, McKinsey predicts outdoor specialist companies will move into everyday lifestyle products. It also predicts that luxury brands will move into permanent collections in the outdoors category.

Blended and quiet outdoors

However, McKinsey suggests that a trend for ‘quiet outdoor’ will follow a similar lead to the ‘quiet luxury’ aesthetic, as consumers look for technical fabrics and performance, but with minimal logos and less flashy branding.

In footwear, McKinsey says we can expect to see performance brands gaining popularity with a more mass market. Trainer resale platform StockX reports that the fastest growing footwear brand in 2023 was Swiss performance brand On, with trade up 15,000% year-on-year.

Styles that straddle both function and style are going to be key. McKinsey explains consumers will be looking for styles that can be worn in both urban and outdoor settings. One of the top-selling trainers at Salomon for example, is the brand’s Sportstyle XT-6 Gore-Tex, which includes the sportswear brand’s usual performance benefits but is designed for everyday life.

The new uniform

On’s co-founder and executive co-chairman David Allemann told McKinsey it is easier for sportswear brands to move into the fashion space than it is for fashion brands to move in the opposite direction. He said: “Of course you can create a sneaker coming from fashion, but it’s just much less credible. Also, if you think about membrane jackets, technical hoodies, track pants or even backpacks, these are now so big in fashion. But ultimately these are all silhouettes that are originally coming from the sports category to make sportswear the new uniform.”

As the cost of living crisis continues, brands with a reputation for durability and utility may become more popular with cash-strapped consumers. It will be interesting to see the competition between outdoor brands and other segments of the apparel sector as McKinsey estimates that higher-end brands, such as The North Face, may be taking sales away from luxury brands.

McKinsey predicts that price points may increase across some outdoor categories, as some brands will lean towards higher end prices, while others will focus on outdoor footwear.

Performance and technical fabrics at scale

Fashion brands looking to capitalise on the trend may be able to create designs that appeal to consumers, or “crack the design code,” as McKinsey describes it. Being able to rapidly scale capabilities with technical materials and suppliers will be key. Testing for performance will also become increasingly important to apparel brands looking to tap into this trend.

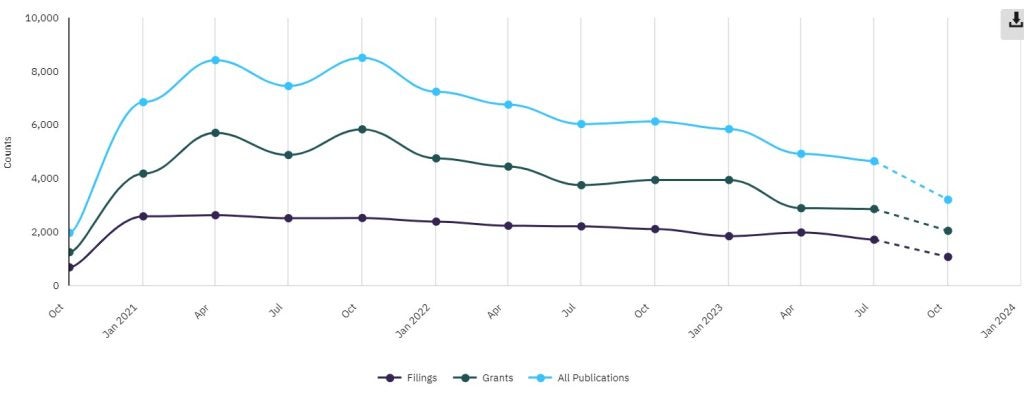

Despite this, GlobalData’s patents data appears to show that the number of patents related to technical fabrics has fallen slightly in the past three years.

Technical fabric patents filed since October 2020

In October 2023, a total of 4,660 patents were filed or granted – down from 7,468 in October 2021. Companies filing patents in this area include sportswear giants Nike and Puma and fastening manufacturer YKK.

The suppliers that outdoor brands use will also become increasingly important. Earlier this month (December) Canada Goose announced it is acquiring its Romanian knitwear partner Paola Confectii with industry experts telling Just Style at the time that supplier acquisitions by premium brands are likely to become more commonplace in the mission to improve margins and gain closer control over supply chains.

McKinsey suggests brands from all segments of the apparel sector will want to embrace the outdoors in its latest form, but brands will need to “redefine the go-to market strategy” and prioritise innovation and materials testing in order to fully exploit this trend.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.