This week’s top apparel-related datasets included a sales slowdown at Puma as sportswear reels from inflationary impacts, Renewcell’s chairman criticising a lack of pace in the industry around climate change which has led to the textile-to-textile recycling firm’s failure, Macy’s Inc swinging to a loss in the fourth quarter prompting a vision overhaul, and a closer look at why resale and rental models are trending with consumers.

Puma sales slowing is evidence sportswear not immune to inflation

Puma this week showed it was bearing the brunt of a slowdown in sportswear as FY sales proved lacklustre on the back of a 9.8% decrease in group sales to €1.98bn ($2.15bn) in the fourth quarter.

While Puma pointed to adverse currencies impacting sales negatively by more than €400m, and the “extraordinary” devaluation of the Argentine peso,” without which it said sales would have grown by more than 8% in the period, it appears a general lull in the sportswear market didn’t help the German brand.

GlobalData senior analyst Pippa Stephens points out that Puma has been significantly impacted by consumers cutting back on discretionary purchases amid high inflation.

Stephens added that a similar trend has been witnessed at sports powerhouse players Nike and adidas, with consumers switching to newer brands like Gymshark and Alo Yoga also impacting their performances.

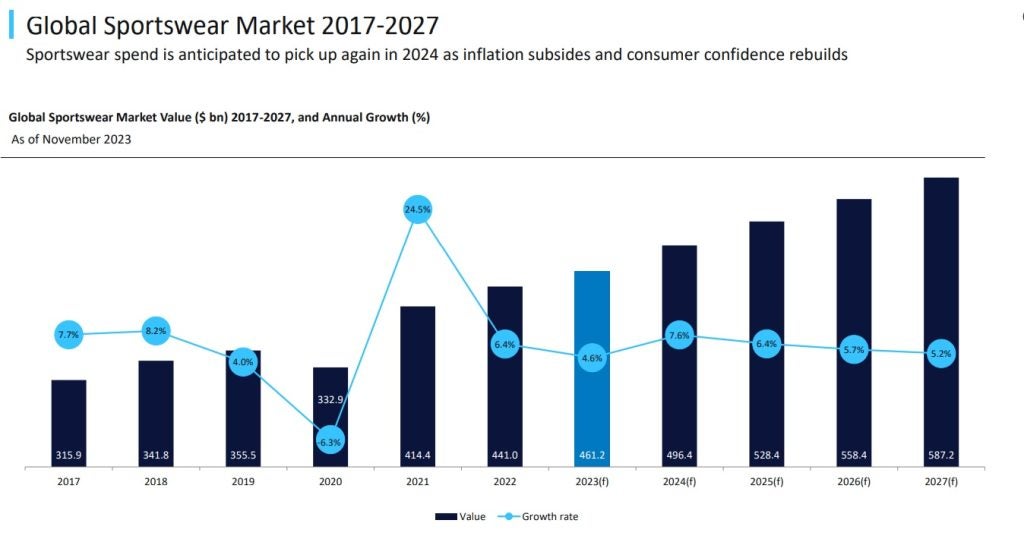

In fact, GlobalData forecasts that after years of tremendous growth, the global sportswear market slowed to only 4.6% growth in 2023, proving it is not immune to the impacts of high inflation.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn it’s Global Sportswear Market report, GlobalData forecasts the market to achieve a CAGR of 5.9% to $587.2bn

In 2023, while growth slowed to 4.6% due to high inflation in Europe and North America weighing heavily on consumer spending, the sportswear market continued to outperform the total apparel market, as the versatility and comfort of athleisure items remained highly desirable as value for money became more important, and consumers continued to prioritise their health and fitness and try out new sports.

While inflation is forecast to soften in 2024, the general economic growth of European and North American markets is expected to remain relatively weak in the next few years, as consumers’ and businesses’ finances take time to recover, hindering the growth of the sportswear market in the medium term.

Renewcell bankruptcy is ‘sad day’ for environment

It’s been a challenging few months for Renewcell and this week the producer of recycled fibre circulose announced its decision to file for bankruptcy.

The alternative fibre producer said its hand was forced after funding talks with shareholders, existing lenders and investors stalled.

Chairman of the board of directors at Renewcell, Michael Berg, called it a “sad day for the environment, our employees, our shareholders, and our other stakeholders, and it is a testament to the lack of leadership and necessary pace of change in the fashion industry.”

Last month the company also announced plans to slash its workforce by 25% in a bid to create savings of SEK35m ($3.4m) per year.

The company’s strategic review was announced in November in response to challenges it faced in terms of sales volume and market dynamic. Renewcell said at the time its decision to conduct a strategic review followed lower-than-expected sales volumes to fibre producers in its third quarter as well as subdued sales in October.

Nicole Rycroft, founder of Canopy described the news as a “sobering moment” for the global fashion industry.

She explained the fashion value chain was not fully prepared to support “this first-to-market leader” in bringing sustainable fashion from niche to mainstream despite the ground being more fertile than ever for a “NextGen transformation”.

Canopy’s founder suggested now is the time for all stakeholders along the fashion value chain to align their actions with their promises and fully embrace the market solutions available to them for real change, as well as for governments to provide stronger incentives to scale circular manufacturing.

Macy's Inc posts Q4, closes 150 stores to transform brand and drive growth

US department store company Macy's, Inc. booked a loss of $22m versus a $275m profit a year earlier.

Sales fell to $5.13bn during the period compared with $5.6bn on the back of weakened demand linked to a "turbulent economy".

The strategy, which is called “A bold new chapter” was developed in collaboration with Macy’s, Inc. leadership and is said to be endorsed by its board of directors and informed by extensive customer research. The ultimate aim is to revitalise the Macy’s brand.

Going forward Macy's said it is eyeing low-single-digit annual sales growth with the new initiative.

Key targets include:

- Low-single-digit annual comparable owned, licensed and marketplace sales growth

- Annual SG&A dollar growth below the historic rate of inflation of 2%-3%

- Mid-single-digit range for the annual Adjusted EBITDA growth

- Capital spending to be below 2024 levels

- Free cash flow to return to pre-pandemic levels.

Rental and resale fashion models continue to grow in popularity

More and more fashion brands are stepping into the resale and rental space, once dominated by the likes of eBay, Vinted and ThredUp, particularly as consumers find discretionary income increasingly squeezed.

Luxury brands like Burberry have penetrated the space as have mainstream players like H&M and Boohoo Group, as well as Inditex’s Zara brand.

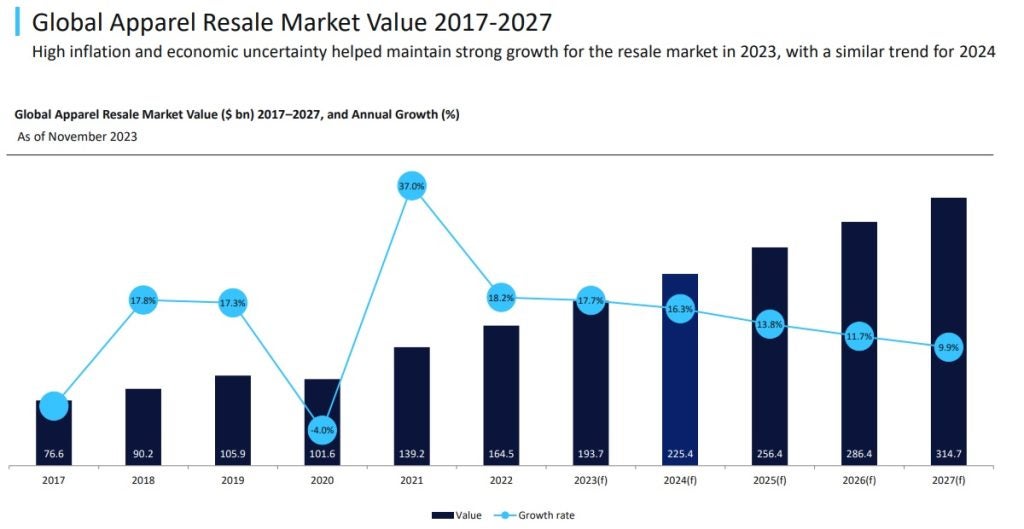

In 2023, the apparel resale market grew by 17.7% according to research from GlobalData, boosted by marketing efforts from players in the space, consumer concerns around sustainability and more cost-conscious shoppers.

In 2024, the apparel resale market is expected to grow a further 16.3%., with growth gently softening in the following years as the sector becomes more established. Between 2023 and 2027, the market is forecast to grow at a CAGR of 12.9%, reaching $314.7bn.

Speaking to Just Style, Gayle Tait, CEO at fashion resale platform provider Trove, said: “In the right model, resale can grow to another revenue channel where a single item can be resold multiple times through its lifecycle, enabling brands to monetise it multiple times.”

While Thomas S. Robertson, professor of marketing at the Wharton School explained brands shouldn’t worry about customers trading down to cheaper/secondhand items.

Instead, they should be focused on the fact that if they “don’t sell their own used products, someone else will.”