This week’s top apparel-related datasets include stalling sales at Geox and falling sales at Victoria’s Secret & Co compared to impressive growth at Hugo Boss and the surprising way that Türkiye’s apparel sector is managing to beat economic uncertainty.

Slowing sales at Geox

Italian shoe and clothing brand Geox says 2023 was a ‘stabilisation’ year after two years of growth as CEO Livio Libralesso is replaced by Dr Enrico Mistron.

Sales at Geox fell 2.2% to €720m ($781.2m) in 2023, which the company attributed to “planned optimisation” of its network and “particularly unfavourable market conditions” in the second half of FY23.

Geox’s chairman and founder Mario Moretti Polegato said that FY23 was “an extremely challenging year” for the company. He said the year was defined by “strong uncertainty arising from the complex macroeconomic framework that directly affected our Target market.”

Türkiye beats economic uncertainty

As Türkiye’s trade bodies anticipate double-digit growth for apparel exports this week, Just Style investigated how apparel manufacturers are continuing to defy the odds despite rising costs, global conflicts and a shrinking market.

See Also:

The after-effects of Türkiye’s February 2023 earthquake, high inflation, increasing production costs, the slowing of the European market, geopolitical tensions and even the lingering side effects of the pandemic were all running themes impacting the Turkish apparel manufacturers exhibiting at the recent Istanbul Fashion Connection (IFCO).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

However, the continued success of both established companies and booming start-ups served as a testament to the resilience pulsating through the country’s industry with innovation helping them to navigate through a landscape fraught with challenges.

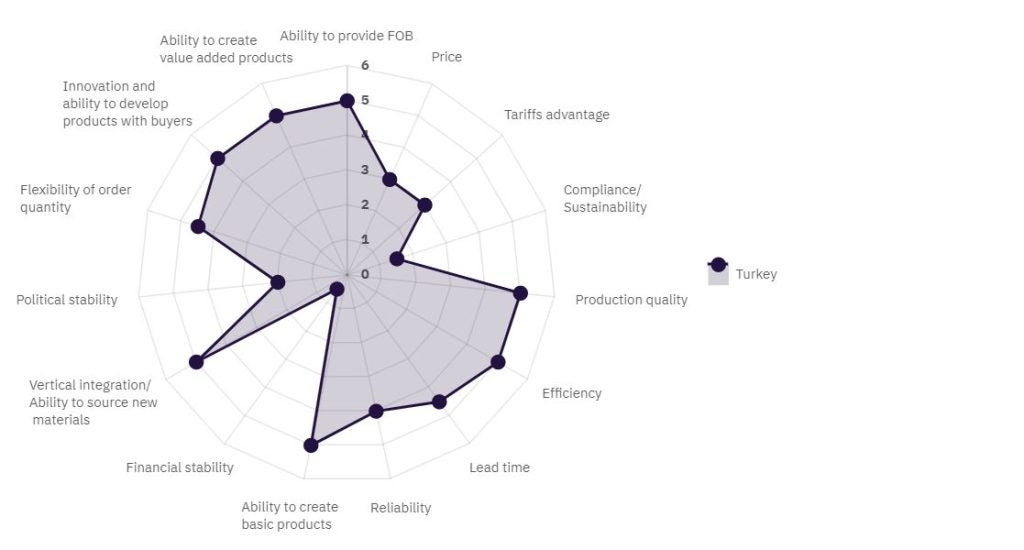

GlobalData’s Sourcing Scorecard gives Turkiye’s highest “excellent” rating on: ability to provide FOB; ability to create basic products; vertical integration/ability to source new materials; production quality; efficiency; ability to create valued added products; and innovation and ability to develop products.

Hugo Boss maintains upward trajectory

Hugo Boss booked a 15% jump in FY revenues to €4.2bn, helped by its premium positioning and value-for-money offering, industry onlookers observe.

Pippa Stephens, senior apparel analyst at GlobalData, commented: “Hugo Boss has maintained its impressive upwards trajectory, as its pivot to more casual ranges and premium positioning have driven its desirability among consumers.”

Hugo Boss said fiscal year 2023 marked another important milestone for the company towards achieving its 2025 financial ambition, which the company raised in mid-2023.

By 2025, Hugo Boss aims to generate revenues of €5bn and an EBIT of at least €600m, representing an EBIT margin of at least 12%.

Target’s efficiency drive pays off

US retailer Target Corp has booked a 48.8% increase in net profit from $2.8bn to $4.1bn for FY23 despite a fall in sales for the year.

Target Corp reported an operating income increase to $5.7bn in FY23 from $3.85bn a year earlier. Sales sank to $105.8bn from $107.6bn.

However, in the fourth quarter, comparable sales declined by 4.4%. Total revenue increased 1.7% on the back of cost-cutting measures taken and actions on inventory management. In 2022 Target pumped $5bn to continue scaling its operations in 2022, with supply chain among its areas of focus.

“Our team’s efforts changed the momentum of our business, further improving our sales and traffic trends in the fourth quarter while driving profitability well ahead of expectations,” said Brian Cornell, chairman and chief executive officer of Target Corporation.

Victoria’s Secret & Co sounds profit warning

CEO of Victoria’s Secret & Co Martin Waters commended the team on its results following a “volatile” fourth quarter in 2023 as it issued a profit warning for FY24.

Waters attributed the positive results in Q4 to disciplined inventory management and cost reductions related to its ‘transform the foundation’ initiative, which aims to modernise Victoria’s Secret’s supply chain operating model.

Victoria’s Secret is forecasting 52-week fiscal year 2024 net sales to be about $6bn. That’s a low-single digits decline compared to 52-weeks from fiscal year 2023.

At this forecasted level of sales, adjusted operating income for fiscal year 2024 is expected to be about $250m to $275m.