This week’s top apparel-related datasets ranged from Zalando’s plan to grab more of the European online apparel market, Temu’s pledge to comply with Hungary’s compliance rules amid an antitrust investigation and Spinnova’s bid to overcome its most recent loss.

Zalando seeks 15% share of Europe’s online fashion market

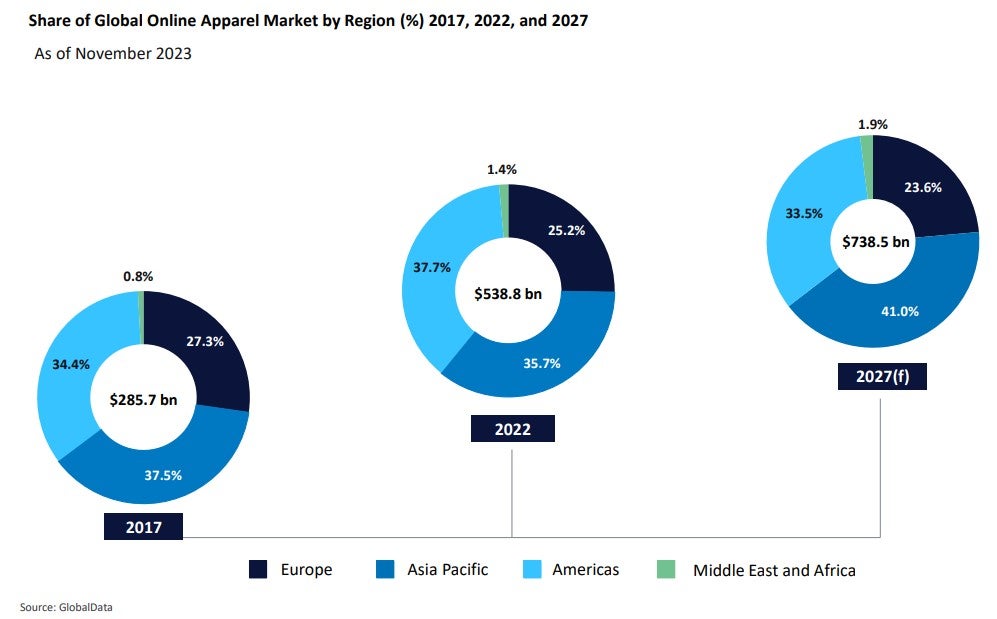

Europe’s share of the global online apparel market is expected to drop from 25.2% in 2022 to 23.6% by 2027, according to GlobalData’s report titled ‘Global Online Apparel Market to 2027’.

However, German online fashion retailer Zalando is keen to grow its slice of the European online fashion market moving forward.

The retailer announced this week that it hopes to use its new ecosystem strategy of tapping both the business to consumer (B2C) and business to business (B2B) sectors to cover the long term equivalent of 15% of the European fashion market, which it said would be worth €450bn.

Zalando’s CFO Sandra Dembeck noted the retailer is using its “healthy balance sheet” to invest in its “strategic priorities” of an “ecosystem vision”.

This includes the quality of the customer experience, new fashion and lifestyle propositions, technology to increase customer engagement and expanding its B2B offering.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMango eyes €4bn turnover by 2026

Spanish fashion retailer said its turnover increased by 15% in 2023, hitting a total of €3.1bn for the first time from €2.7bn the year before.

The retailer has also revealed that as part of its strategic plan for 2024-2026, it aims to achieve a turnover of €4bn in two years’ time.

Mango’s chief financial officer Margarita Salvans said the company plans to focus on profitability as part of its strategy and will use AI and other new technology to improve efficiency.

César de Vicente, global retail director at Mango added the company wants to open 500 more stores and refurbish 150 by 2026.

Temu goes under spotlight in Hungary

Chinese online marketplace Temu grew in prevalence in the latter half of 2023, according to GlobalData’s ‘Global Online Apparel Market to 2027’. GlobalData noted that its free international delivery and extensive product range at ultra-low prices has helped the retailer to connect shoppers with sellers and manufacturers directly.

The report added that Temu’s rapid expansion since its founding in 2022 and the roll out of shipping to Europe in April 2023, highlights its disruptive capabilities in the growing online apparel market.

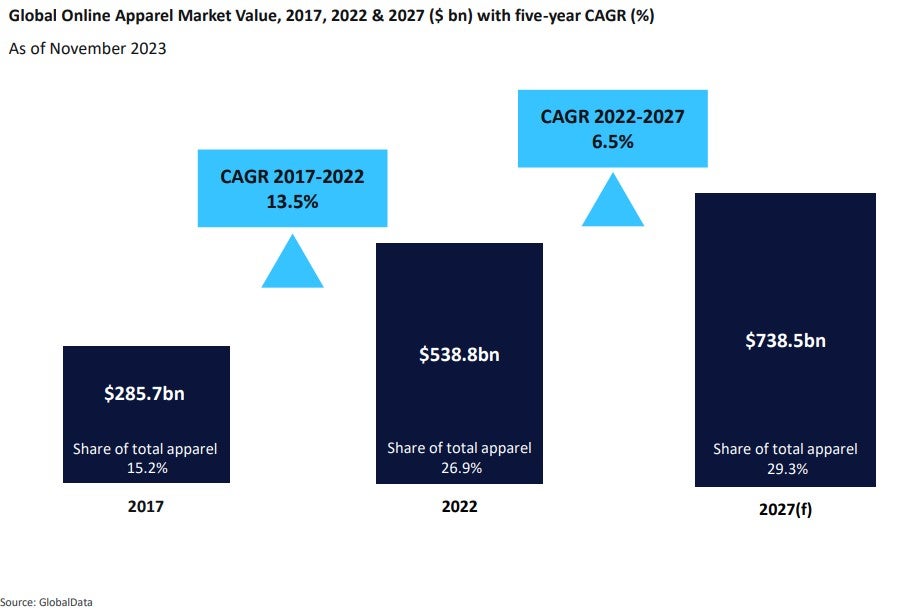

The global online apparel market is set to be worth $738.5bn by 2027 and make up a 29.3% share of total apparel, according to GlobalData. Temu is successfully tapping into the European share of this market by taking advantage of high inflation rates and consumers’ tightening of non-essential spending.

The competition authority claimed the online marketplace could be “using non-existent discounts, psychological pressure and misleading green messages”.

A Temu spokesperson told Just Style it is eager to learn and adapt to ensure it meets the expectations and preferences of local consumers and will ensure its operations align with the highest standards of compliance.

John Lewis returns to profit in tough UK market

UK retailer John Lewis Partnership reported a return to profit for FY23/24, which it plans to invest back into its retail business with GlobalData lead retail analyst Zoe Mills stating it is moving in the right direction.

She shared that as inflation rates are forecast to decelerate throughout the year, the retailer will hope to entice lapsed shoppers back as they start to feel more financially secure.

John Lewis sits in the mass to premium price range of the apparel market which takes a much smaller share of the UK apparel market compared to mass in general.

Source: GlobalData

GlobalData’s ‘The Apparel Market in the UK & Forecasts to 2026’ report suggested the premium category is expected to grow to 19.8% in 2026 from 19.2% market share in 2023. The mass segment on the other hand is expected to decline from 51.4% in 2023 to 51.1% in 2026.

The report explained the more expensive price segments of the UK apparel market will benefit from their more affluent shopper base which will be less impacted by rising inflation, as well as more consumers trying to shop sustainably and prioritising value for money, with premium and luxury brands often selling more classic and higher quality products.

However, Mills pointed out John Lewis must take advantage of its services and advice being its point of differentiation. It should ensure it offers a rounded proposition that is more than just the products it sells, and it must continue to focus on expanding its staff’s knowledge to provide shoppers with good customer service.

She added: “While inflation rates will soften throughout 2024, volumes are expected to be flat or negative, highlighting that John Lewis must focus on price alongside services to entice shoppers to spend and trade up from value and discount retailers.”

Spinnova unveils turnaround plan amid losses

Finnish alternative fibres supplier Spinnova has warned the global textile industry to get on board in moving away from conventional fibres as its annual sales slump, prompting a restructure.

Spinnova has announced potential job losses, a restructure of its management team and a new focus on technology sales in an effort to turn around the company after FY23 (12 months ending December 2023) sales and profit sank.

For FY23 Spinnova saw its revenue drop to €10.6m ($11.54m) from €24.2m a year earlier. Its operating losses widened to €20.9m from €13.1m and its loss for the period was €19.5m compared with -€15.1m.

The news comes just weeks after textile-to-textile recycling company Renewcell announced it is filing for bankruptcy at the Stockholm District Court due to a lack of sufficient financing and not enough interest in recycled fibres from the wider fashion industry.

Spinnova’s CEO Tuomas Oijala commented: “If the global textile industry wants to shift its material base from conventional materials, such as cotton and polyester, to more sustainable alternatives, we need all the players in the textile value chain on board.”