Data compiled by GlobalData reveals the overarching theme of AI accounted for most apparel patent publications between 1 July and 31 July 2023 with over double the amount of publications compared to the month before.

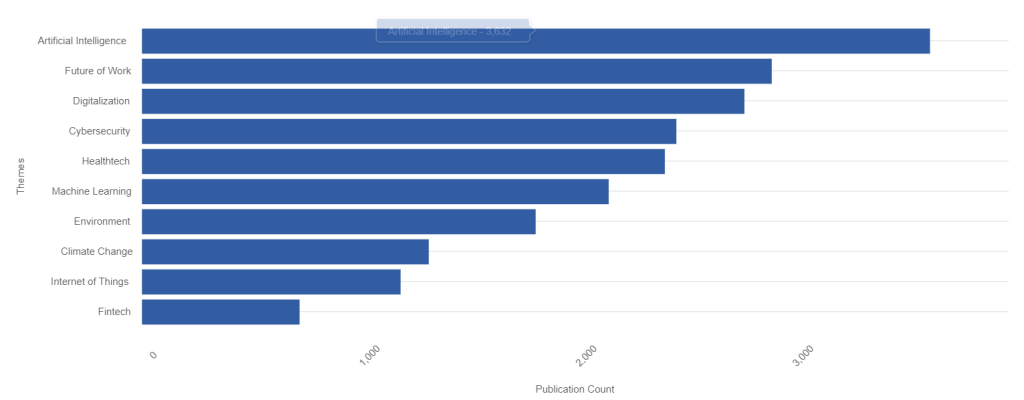

Apparel patent publications by theme in July 2023

Source: GlobalData

The data shows the number one AI theme had 3,632 published patents, followed by the future of work with 2,902 patents.

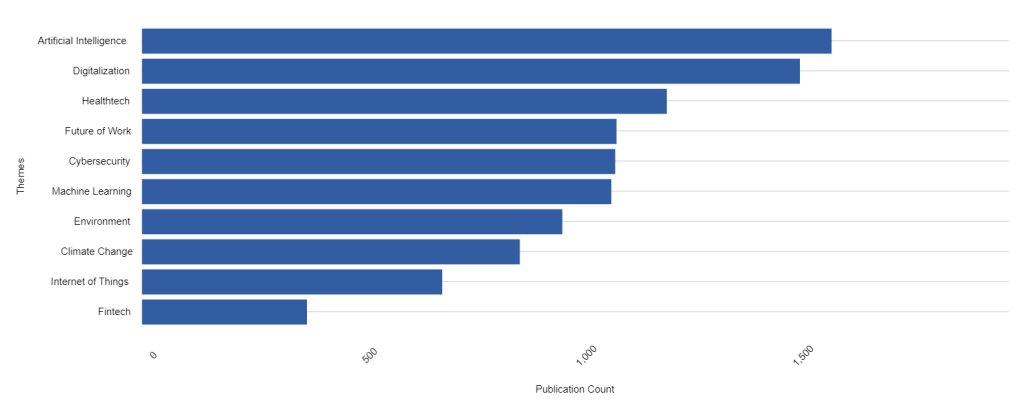

Apparel patent publications by theme in June 2023

Source: GlobalData

The number of total AI publications in July 2023 was more than double that of the month before, which only had 1,589 patents. Plus its biggest contender between 1 June 2023 and 30 June 2023 was digitalisation with 1,516 total publications and the future of work theme sat in fourth place with 1,093 publications.

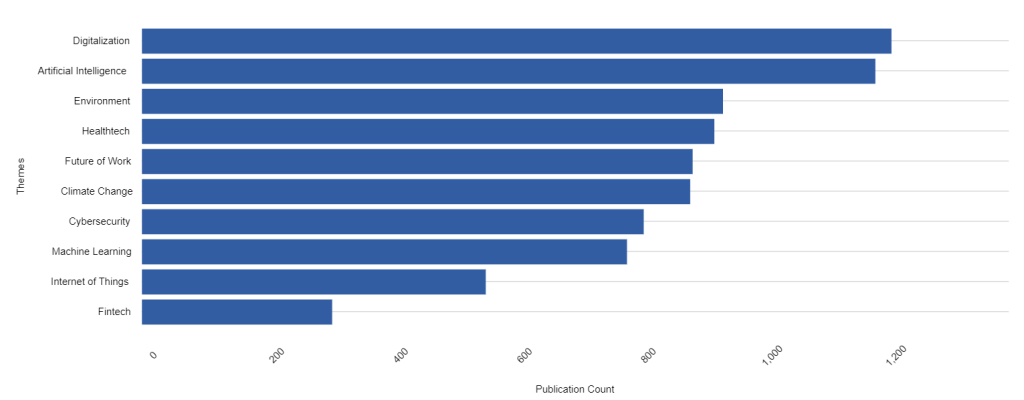

Apparel patent publications by theme in July 2022

Source: GlobalData

AI has climbed the ranks significantly since July last year when digitalisation sat in first place with 1,209 total publications and was closely followed by AI with 1,183 total publications.

Why is AI climbing the ranks as a key theme for apparel patents

It is increasingly being used in the apparel supply chain to enhance processes.

This idea was put into practice in May when KolAi Denim, a leading online platform for denim laser design, claimed to be the first and only AI platform to help denim designers create high-quality, natural-looking designs in minutes.

Gherzi Textil Organisation partner Robert Antoshak has shared his reservations about AI being used within the apparel supply chain, but can also see it being a disruptive force for good.

He says: "Indeed, as we've seen with all technological innovations over time, some people successfully embrace those innovations — and some don't. Or can't, as their livelihoods are disrupted. More simply stated: with every technological innovation comes good and bad, costs and benefits.

Each week, Just Style’s journalists analyse data on patent filings and grants that illustrate innovation trends in our sector. These patent signals show where the leading companies are focusing their research and development investment, and why. We uncover key innovation areas in the sector and the themes that drive them.

This new, thematic patents coverage is powered by our underlying Disruptor data which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors.