The Indonesian government is to relax foreign investment restrictions on a number of industry sectors – including fabric printing – in a bid to encourage exports and capital inflows.

The measures are the government’s 16th economic policy package since 2015 to try to strengthen Indonesia’s business environment and support growth.

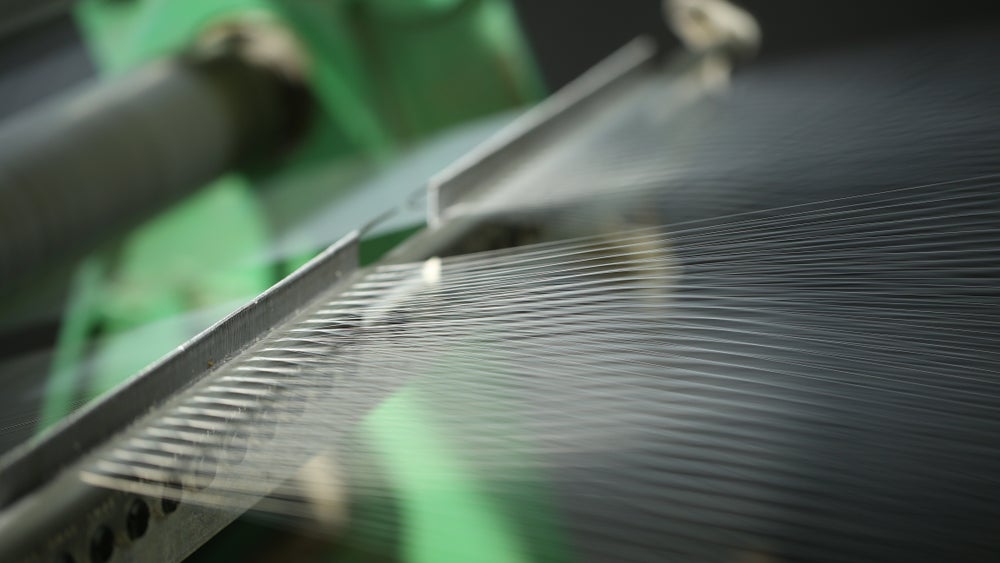

Fabric printing is one of 54 business sectors that were previously on a ‘Negative Investment List’ that meant they were partially closed to foreign ownership, and will now be opened for full foreign ownership.

Analysts at Moody’s Investors Service say the credit-positive measures “support headline growth and reinforce steps over the past year to stem rupiah depreciation and staunch capital outflows.”

According to the Indonesia Investment Coordinating Board, total direct investment contracted 1.6% year on year in the third quarter of 2018 because of a 24.2% fall in foreign direct investment.

Moody’s analysts believe Indonesia will see real GDP growth of 4.8% in 2019 and 4.7% in 2020, after 5.0% this year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Our estimates factor in a slowdown in domestic demand, as significantly tighter financing conditions and slowing global demand weaken exports. However, as with other reforms over the past two years, the [new] measures are incremental and will help remove some regulatory complexities and hurdles to investment.”

They add: “The latest initiatives target boosting exporters’ revenue and keeping it within the country to boost dollar liquidity. The measures do not remove the risk of renewed rupiah depreciation but reduce the likelihood of intense downward pressure on the currency.”